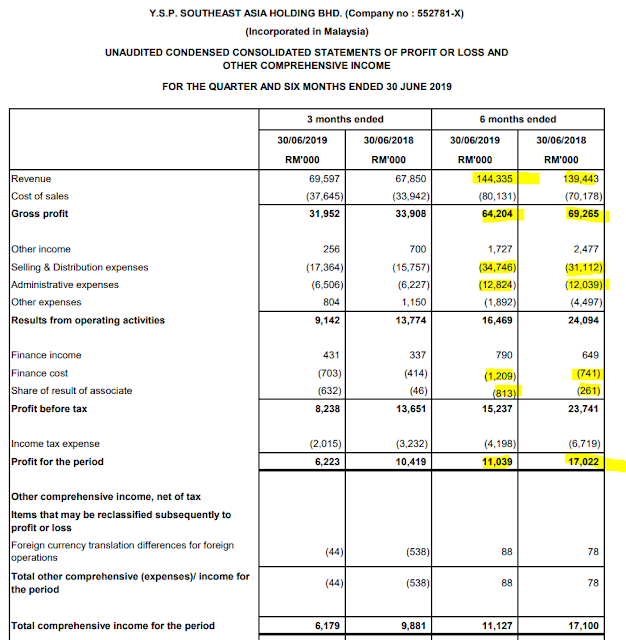

- Revenue increased by 3.5% however gross profit reduced 7.3% due to increase in raw material cost. Gross profit margin was 44.48% while profit before tax margin was 10.56% which is still acceptable. 🔻

- Selling, distribution and admin expenses increased by 10% which is higher as compare to revenue increase of 3.5%. 🔻

- Finance cost increased by 63% however this do not post as a threat to the company as the company have interest income to offset. =

- Net profit dropped by 35% mainly due to higher cost of goods sold, higher operating expenses, higher depreciation of RM 1.9 million and foreign exchange loss of RM 501K, last year there is a forex gain of RM 2.1 million as shown in the info below. Last year, the company spend RM 28 million on purchase of PPE, the higher depreciation expenses should derive from there.🔻

- Although the profit of YSPSAH drops, however its net cash generated from operating activities increase thus increase its cash position to RM 0.39 sen per share. 🔺

- The management were cautiously optimistic of its performance moving forward. =

Comments

- It is quite obvious that YSPSAH wont be able to achieve a higher net profit for 2019 as its current net profit cumulative 6 months is only 36% of 2018 profit. However, its cash flow still remain strong.

- Valuation wise, YSPSAH is currently trading at RM 2.31, PE is 13, DY is 3.6%. PE 13 is deemed to be fairly value for YSPSAH. Assuming if the full year EPS is 18 sen for YSPSAH, at PE 10, YSPSAH is at RM1.8, its DY will be 4.7%.

No comments:

Post a Comment