- Rcecap is a subsidiary of Amcorp Group Berhad and involved in 3 business segment namely:

- Consumer Financing - Provide personal financing to government employees where the repayment are done through a salary deduction scheme whereby the installment payments are deducted from salary of those participating employees on a monthly basis. (only focus on personal loan)

- Commercial Financing - Factoring (business sells its accounts receivables at a discount to a factoring company which provides quick cash to the business) & Confirming (business needs to confirm an order of goods and the confirming company undertakes to pay the supplier of goods upon delivery on behalf of the business).

- Payroll collection - EXP’s collection service attends to deductions in payroll systems of government departments under the purview of Accountant General’s Department of Malaysia.

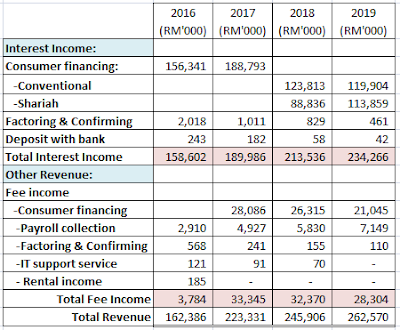

- Rcecap derive its income mainly from consumer financing which accounts for 89% of its revenue in 2019.

- Minimum dividend payout ratio of 20% - 40% of its net profit.

- Rcecap is listed in 1994 and transfer to the main board in 2006 and introduce payroll collection business in 2014.

Financial Highlight

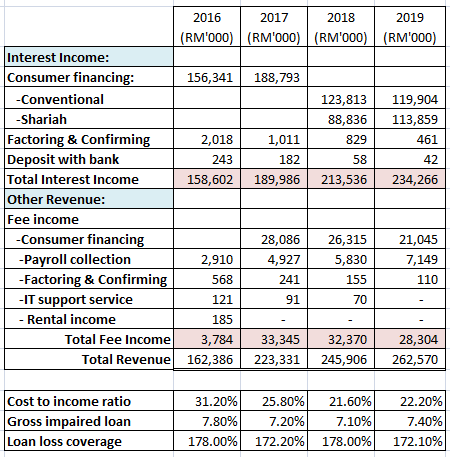

- We will focus its growth starting 2017 as RCECAP consolidate every 4 shares into 1 in 2017. Their NPL prior to 2017 is extremely high due to low quality of loan. However, the company started to focus on the quality of loan and consolidate its shares to make the company better.

- CAGR on revenue and net profit from 2017 - 2019 was 5.54% and 6.56% respectively.

- CAGR on EPS from 2017 - 2019 was 5.47% which is in line with its revenue and net profit growth.

- Dividend payout increase every year form 2017 - 2019 and in 2019 the company have a dividend payout ratio of 32%. (Bear in mind that the company is willing to share its profit up to 40% with its shareholder)

- Since it consolidate its shares in 2017 its ROE improved to 17% from below 10% which is on par with the ROE of Aeoncr.

- Gross financing and net financing receivable grew at CAGR of 4% from 2017 - 2019 however its gearing ratio actually decreased. This means the company utilized its equity effectively.

- Non performing loan also decreased to 4% since it consolidate its shares.

- Its interest income grew steadily from 2016 to 2019.

- Cost to income ratio improved from 31.2% to 22.2% in 2019 which is a big improvement in cost control.

Future Prospect

- Remain focus in the niche market and bringing in quality loan remain as main priority to bring down the non performing loan.

Strength

- Focus on quality loan from government servant where the salary will be auto deducted for payment to Rcecap before paying to the borrower.

- Management team is willing to share its profit with its shareholder. Dividend payout in 2017: 3sen, 2018: 7sen, 2019: 9sen. Management is willing to share up to 40% of its profit with its shareholder.

- Low gearing ratio which means there is more room for the company to take up more loan to expand its business.

- Improvement in management effort to improve its cost to income ratio as well as to reduce its non performing loan.

Weakness

- Limited business segment as the company only focus on personal loan of civil servant.

- Unable to check CCRIS from bank negara to ensure the debts payment background of the borrower however the salary of the civil servant will be deducted automatically to settle the loan before paying out to the borrowers.

Valuation

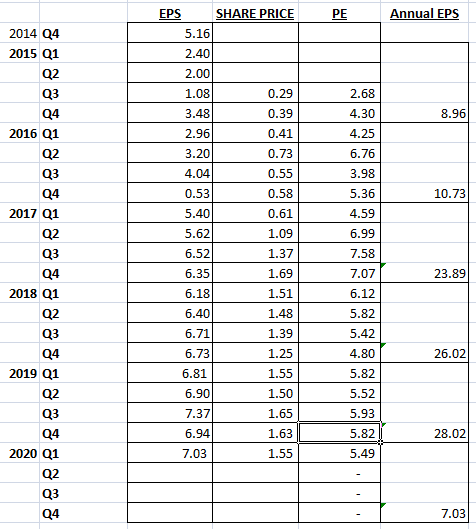

- 2017: Share price - RM1.69, EPS - 23.89sen, PE - 7.07

- 2018: Share price - RM1.25, EPS - 26.02sen, PE - 4.80

- 2019: Share price - RM1.63, EPS - 28.02sen, PE - 5.82

- From the above comparison, we can see the its EPS grew 17% however its share price maintain at RM1.60.

- Assuming if Rcecap distribute 10 sen of dividend in 2020, at the price of 1.55, its DY is 6.5%.

- Rcecap is worth PE of 7 - 8. At PE 7 Rcecap is worth RM1.96. At PE 8, Rcecap is worth RM2.24

Technical Analysis

- Rcecap is currently trading below its short term and long term moving average and the next support is seen at 1.42.

No comments:

Post a Comment