- Apex Healthcare Berhad started off as a retail pharmacy called Apex Pharmacy in Melaka in 1962 and subsequently listed on the 2nd board of Bursa Malaysia in year 2000. After 3 years, Ahealth successfully transferred to the main board in 2003.

- Ahealth revenue grew from RM 259 million in 2008 to RM653 million in 2018 (2.52 times)

- Ahealth PBT grew from RM 19 million in 2008 to RM 69.3 million in 2018 (3.64 times)

- Ahealth share price grew from RM 0.11 in 2008 to RM 1.9 in 2018 (17 times)

- Ahealth is the largest pharmaceutical company by market capital in Malaysia which is close to RM1 Billion.

- Ahealth has 3 main business segments:

- Develop, manufacture and market XEPA brand generic drugs and medical devices.

- Wholesale & distribution of pharmaceutical & healthcare products.

- Operating 60 outlets of Apex Pharmacy in Malaysia & Singapore and manufacture orthopedic devices, components and surgical instruments (e.g. screws, plates, implants, intra-medullary nails, pins, external fixators). Ahealth only venture into orthopaedic industry in 2013 through its 40% equity in Straits Apex Sdn bhd.

- Manufacturing of generic drugs contributes 61% of Ahealth profit before tax followed by wholesale business (33%) and orthopaedic & pharmacy operations (7%).

- Manufacturing of generic drugs has the highest profit margin which is 27%. Do take note that profit margin for orthopaedic & retail pharmacy operation improved from 5% in 2017 to 10% in 2018 mainly contributed by high profit margin in orthopaedic manufacturing (we will look into this later)

- 68% of its revenue were from Malaysia, 30% from Singapore and 2% from Other countries.

Financial Highlights

- Revenue and net profit grew at CAGR of 7.69% & 11.75% respectively from 2013 - 2018.

- Gross profit margin is around 22% - 23% while net profit margin is around 7% - 8%.

- Ahealth has been consistently paying out around 30 - 40% of its profit as dividend over the 5 years.

- Ahealth cash holding has grew from RM32 million in 2013 to RM81 million in 2018 and has no bank borrowings prior to 2018. In 2018, Ahealth incurred a bank borrowings of RM29 million mainly because of the expansion of SPP NOVO where Ahealth invested a whopping RM96.5 million in purchase of PPE in year 2017 & 2018. Even after investing RM96 million in SPP NOVO, Ahealth still remain as a net cash company with 0.44 sen of dividend per share.

- Ahealth has been generating positive operating cash flow as well as positive free cash flow all these while. The reason that the free cash flow in 2018 was negative was due to the heavy investment in SPP NOVO for its next phase of growth.

- Income tax rate for 2017: 20.62%, 2018: 15.30% mainly because of additional RM4.2 million of reinvestment allowance from SPP NOVO.

- Impairment from trade receivables were 2.06% in 2018 & 1.37% in 2017 was deemed to be very well managed.

8. From the above info we can conclude that Ahealth sales to the government sector and export market grew by more than 100%. Majority of its sales were to private sector in Malaysia

and Singapore as it dominates 87% of its revenue.

Future Prospect

- SPP Novo is the third oral solid dosage facility with automation system in the Melaka Campus and is set to triple the production capability when it is in full operation. (In line with industry 4.0 concept)

- Ability to tender for large order book with its new SPP Novo.

- In September 2017, Xepa Pattinson has been award with EU GMP certificate (achieving this license prove that Xepa brand medicines are of consistent high quality and meet the requirements of the marketing authorisation or clinical trial authorisation).

- Investment of 40% in Straits Apex Sdn bhd which is going to be the next growth engine for Ahealth. Revenue and PAT of Straits Apex has been growing at CAGR of 23.24% and 52.71% respectively from 2014 - 2018. Its profit margin is also constantly improved over the 5 years as shown in the table below. (the growth rate is very insane)

- Straits Apex secured a new customer and in the process of setting up facility and testing for the new customer in 1Q19. Notably, the contract manufacturer of surgical grade orthopaedic devices has managed to secure new customers as a result of the US-China trade tension as most of its customers are US multinational corporations (MNCs).

Strength

- Strong balance sheet with proven track record on earning stability.

- Ahealth is in the economic resilience industry as pharmaceutical products are needed regardless of economic conditions.

- Government sector as at 2018 has only contributes 7% to Ahealth revenue, hence, there are more room to growth and the fact that 90% of its sales are to private sector meaning the earnings are more stable as it is not overly depending on single major client.

Weakness

- Before the production capacity of SPP Nova being taken up by new orderbook, the depreciation and finance cost tend to drag Ahealth earnings lower.

2019 Q2 Report

- Ahealth profit margin shrink slightly as compared to 2018 however overall, the company performance is still decent as its net profit margin is still within the range of 6% - 8%.

- Ahealth used to be a net cash company however in 2019 a RM700k of finance cost incurred due to the borrowings to built SPP Nova. The interest expenses is about 28% of its net profit.

- Please take note that the contribution from its associates Straits Apex SB improved by 30%. Contribution from Straits Apex SB would become its next pillar of growth if its continue to grow at this speed.

- Ahealth revenue for cumulative 2Q increased by RM13 mil (4.05%) however its receivables dropped RM2 mil (1.2%) and its borrowings dropped RM 2.8 mil (9.5%). Payable increased by RM9 mil (7.7%). [From this we can see the effectiveness of the management on handling the cash flow. Revenue ⬆ but the money that the customers own Ahealth ⬇ while the money they own the supplilers ⬆. The money they own to the bank ⬇]

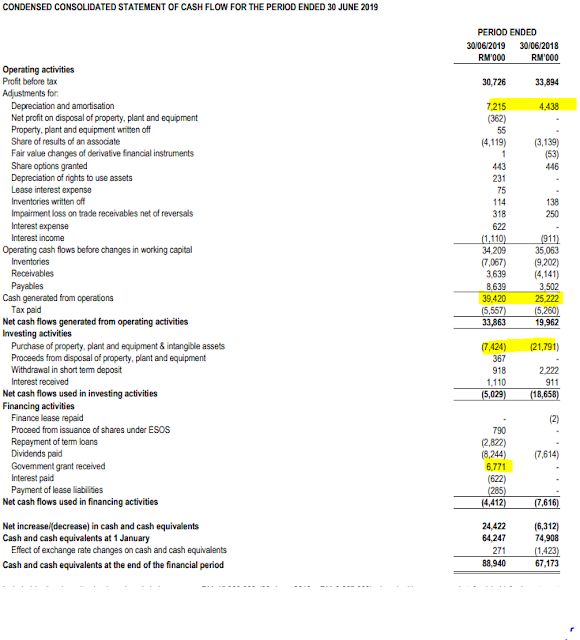

- 6 months depreciation of 2019 accounts for RM7 mil to Ahealth profit and loss account however, regarding of the high depreciation expenses results of SPP nova, its cash flow generated from its operation remain strong at RM39 million.

- As we can see that Ahealth no longer need high capex for SPP Nova therefore the amount spend on PPE reduced by 60% which enable them to pair its debts down sooner than you can expected with its strong free cash flow.

- Ahealth receive a government grant of RM6.7 mil in 2019 which contributes to their strong cash position too.

- The company expect a satisfactory performance for 2019 and working to maximize the utilization rate of SPP Novo.

Valuation @ RM2.19

- At the price of RM 2.19, its PE is 18.3 which is at its highest over the 5 years period. EPS for 2019 expected to be lower than 2018, therefore it is unreasonable for Ahealth to have higher share price than 2018.

- Average PE for Ahealth is 14.5, therefore if the share price reach RM1.73 it would definitely be a good entry point for Ahealth.

- However please take note that if Ahealth successfully reduce its debts hence its interest expenses, with the additional capacity from SPP Novo and contribution from Straits Apex SB, Ahealth could easily pair down its PE by then. Therefore, 2019 will be a resting year for Ahealth before it continue to shines.

- Ahealth is never a dividend stock therefore i wont be valuing it with its DY.

Technical Analysis

Technically Ahealth is still in a downtrend however it has successfully break above its 200MA which means it could be at a short term bullish.

No comments:

Post a Comment