- Magni has 2 business segments:-

- Garment manufacturing: contributes 90% to its revenue and 96% to its operating profits. Profit margin for this segment is 11.03%.

- Packaging manufacturing: contributes 10% to its revenue and 4% to its operating profits. Profit margin for this segment is 3.8%.

- 93% of garment revenue is derived from one single customer which is NIKE. Therefore, Magni's business is highly affected by the business of NIKE.

- 90% of its revenue are derived from export, with US, European and China being the top 3 countries.

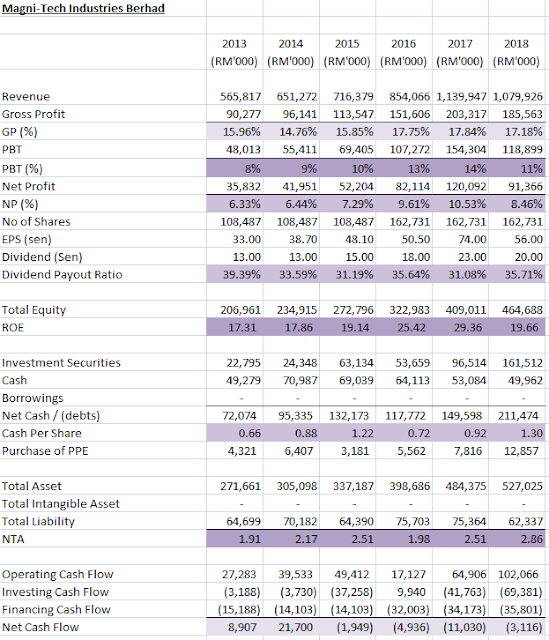

Financial Highlight

- Revenue reduced by 6% while PBT reduced by 30% in 2018 from 2017. The main reason for PBT to decrease by 30% is because in 2017, there is a forex gain of RM 10 million while in 2018, its forex gain is merely RM 1.8 million. 2nd reason is because its admin and distribution expenses increased by RM 11 million in 2018 although the revenue dropped 6%.

- Dividend payout ratio is 35% of its net profit.

- Magni has high ROE of approximately 20%.

- I include investment securities to calculate its net cash position as investment securities consist of money market fund, shares and unit trust and it is actually a current asset. Taking account of this, Magni net cash position has reach a record high of RM 211 million or RM 1.30 cash per share in 2018.

- Allowance for impairment is merely 1% of its trade receivables which is very healthy.

Futures Prospect

- There is a lack of info on its futures prospect in the annual report.

As at Q3 of 2019

- PBT margin improved to 12.7% as compared to 11% in 2018.

- EPS for 3 quarters in 2019 has already accounted 88% of 2018 EPS (2019 can definitely perform better than 2018)

- Drop in revenue is due to a drop in sales.

- Cash and investment securities increased to a record high of RM 249 million as compared to RM211 million in 2018. Main reason for its cash to increased to RM 85 million is due to disposal of investment securities, not from operating.

- Garment manufacturing profit margin improved to 12.68% as compared to 11% in 2018 due to higher gain on foreign exchange by RM8.679 million, higher dividend income from money market unit trusts, and lower operating expenses incurred.

- Packaging profit margin improved to 5.4% as compared to 3.86% in 2018 due to lower operating expenses incurred and higher miscellaneous income.

- Not much being mentioned other than its usual comment.

Strength

- Strong balance sheet

- Assist NIKE which is a world renowned brand to manufacture its apparel.

- Export business where 90% of its revenue is derive from overseas therefore, strong USD is beneficial to magni.

Weakness

- Over dependent on NIKE as NIKE alone contributes over 80% of its revenue (however, magni has been helping NIKE to manufacture their garment for over a decade)

- Lack of future prospect/growth internally. The growth is mainly from NIKE.

Valuation @ RM 4.50

- Generally Magni's PE is ranged between 6 - 8 and can go up to 10 when the market is very bullish on its prospect. Therefore, i will conclude that a fair PE for Magni is 7 - 8.

- At RM 4.50, its PE is currently 7.25 (which is deemed to be fairly valued unless moving forward its earning is able to pull its PE lower) and its DY is 4.44%. At PE 8, Magni is worth RM 4.90. At PE 6, Magni is RM 3.70 and anything below RM 3.70 , there is a margin of safety for Magni (assuming the earning ability remains)

Technical Analysis

- Technically, Magni is still moving in consolidation with support at 4.1 & 3.88.

No comments:

Post a Comment