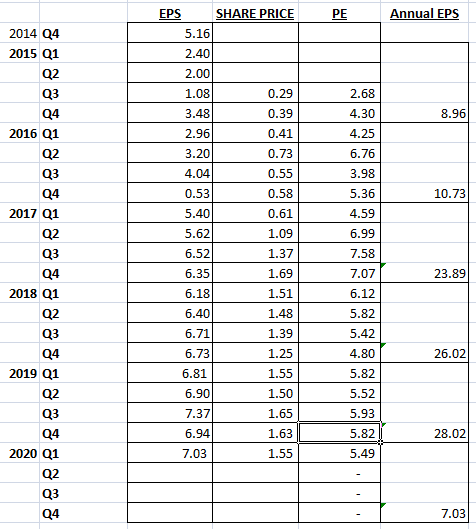

The share price of SCGM reached its peak in 2017 at approximately RM 3.20 before dropping 76% to a low of RM 0.76 and recently rebounded 55% from its bottom to close at RM1.18 on 27 September 2019. So Is RM 1.18 a good entry price for Investor? To answer this question, we will do a comparison on its financial and share price for year 2017 & 2019 respectively.

To be honest i think it is unfair to value SCGM based on net profit as it doesn't give a fair view on SCGM's operating profit due to its high depreciation incurred in 2019 through the factory expansion. Therefore, i would prefer to focus at its earnings before interest, tax and depreciation (EBITA) and free cash flow to justify its core operating profit.

SCGM Financial in 2017 vs 2019 vs Q1 2020

However there are more that we should look at for future share price movement.

Below is some sharing by 笔随意走

SCGM AGM 简报 (Sept 24,19)

- 自从搬迁到新厂后,总产能达到每年6.2万 吨 (62.6million kg)

-目前的产能使用率大概在40-50%, 最佳舒适使用率预测是70%左右,希望可以在此财政年FY2020 第四季度可以达到(明年年4月之前)

- 三分之一的营业额来自出口,区域则来自本地

- 可生物降解(biodegrable )产品目前是占了少于 10%的生意量,原因是 太贵,市场不接受

- 原料(resin)占了生产成本的大概60% (原料品种:PET, PP, PS)

- 原料供应商源自本地

- 原料吨货量大概 1.5 个月 (属于最佳时限,不会卡cash flow)

- 目前原料低价是好事(自从四月开始),凡生产的产品任何起跌价都会有lag effect ,不会马上反映出来

- 贸易战受惠 订单转移

- 受惠于本地食品行业的蓬勃发展(最近流行打包,foodpanda 那些,有助提升产品需求)

- 政府减少塑料产品使用政策的影响: 短期内还没有真正可以取代plastic 的原料,plastic依然是消费者首选

- 盈利逐渐恢复,上个财政年出现亏损因为新建筑物和机械开始减值,搬厂额外开销,原料价格高企

- 资产折旧 建筑物:摊平二十年,一年比以前多RM 2mil ,至于机械则为10年

SCGM Financial in 2017 vs 2019 vs Q1 2020

- Although the net profit of SCGM shrink tremendously, its revenue continue to grow and expected to achieve a new high of RM 222 million in 2020. (there is definitely no issue in the top line as we are sure that the company keeps growing)

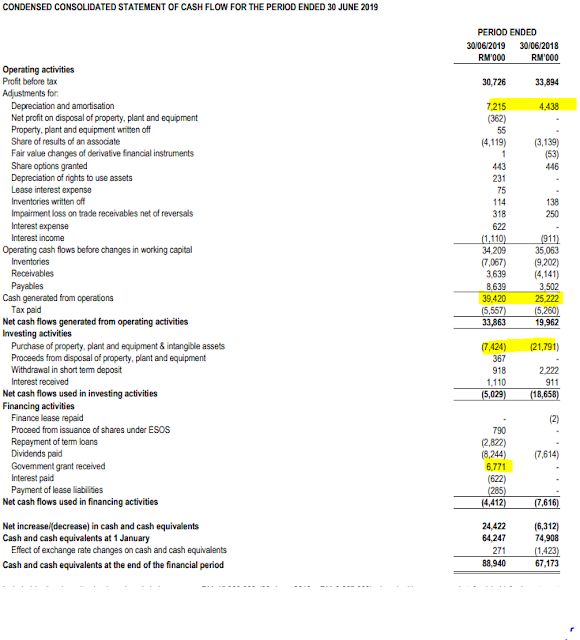

- As mentioned above, instead of looking at its net profit i would prefer to focus on its EBITA to have a better view of its operating profit. EBITA dropped from RM35 million (2017) to RM 18 million (2019), a drop of 48%. In Q1 2020, SCGM posted an earning before interest, tax & depreciation of RM 7.2 million. Assuming if SCGM is able to achieve this in the remaining 3 quarters, the full year EBITA would be RM 29 million. (At least we know that SCGM is still having positive core operating profits and do take note that its EBITA margin in Q1 2020 improved to 13.05% from 8.47% in 2019).

- Its interest and depreciation for 2020 is expected to be RM 5.4 million and RM 14.8 million respectively which is same as 2019, therefore i would safely say that the worst is over.

- SCGM gearing ratio reduced from 64% in 2019 to 59% in Q1 2020. (As long as SCGM continue to reduce its debts, the interest expenses should reduce as well hence increase its free cash flow)

- Next we will look at its cash flow. The free cash flow generated by SCGM in 2017 is RM 77 million while in year 2018 & 2019, its free cash flow is negative due to capex on expanding its factory. However we can see that its free cash flow is positive again at RM 9.5 million in Q1 2020. (Assuming if SCGM is able to maintain its free cash flow at this level for the remaining 3 quarters, SCGM is able to generate a free cash flow of RM 38 million. Currently SCGM has a bank borrowings of RM 96 million, with RM 38 million of free cash flow per year, SCGM is able to bring down its gearing ratio to a comfortable level in 3 to 5 years time).

- SCGM is a company that is willing to share its profit with its share holder as it used to have a dividend payout ratio of 60 - 70%. However in recent years, due to its tight cash flow and lower profit, dividend drop massively. (Assuming if SCGM is paying 0.25 sen of dividend per quarter, full year dividend paid will be 1sen which is equivalent to a yield of 0.85% at the price of RM 1.18. SCGM will not be a dividend counter until it pair down its debts).\

Now back to the questions on should investors "chase high" on SCGM Berhad at RM 1.18?

In point 2, i did an assumption that the full year EBITA for 2020 would be RM 29 million up from RM 18 million in 2019, an increase of 61%. Share price of SCGM had rebounded from the rock bottom of RM 0.76 to RM 1.18, an increase of 55% which means the current share price is reflecting its earning for the remaining 3 quarters in 2020.

With this i conclude, if SCGM is able to achieve an EBITA of RM 29 million in 2020, its share price should be somewhere RM 1.20 - RM1.30 to be fair.

However there are more that we should look at for future share price movement.

Below is some sharing by 笔随意走

SCGM AGM 简报 (Sept 24,19)

- 自从搬迁到新厂后,总产能达到每年6.2万 吨 (62.6million kg)

-目前的产能使用率大概在40-50%, 最佳舒适使用率预测是70%左右,希望可以在此财政年FY2020 第四季度可以达到(明年年4月之前)

- 三分之一的营业额来自出口,区域则来自本地

- 可生物降解(biodegrable )产品目前是占了少于 10%的生意量,原因是 太贵,市场不接受

- 原料(resin)占了生产成本的大概60% (原料品种:PET, PP, PS)

- 原料供应商源自本地

- 原料吨货量大概 1.5 个月 (属于最佳时限,不会卡cash flow)

- 目前原料低价是好事(自从四月开始),凡生产的产品任何起跌价都会有lag effect ,不会马上反映出来

- 贸易战受惠 订单转移

- 受惠于本地食品行业的蓬勃发展(最近流行打包,foodpanda 那些,有助提升产品需求)

- 政府减少塑料产品使用政策的影响: 短期内还没有真正可以取代plastic 的原料,plastic依然是消费者首选

- 盈利逐渐恢复,上个财政年出现亏损因为新建筑物和机械开始减值,搬厂额外开销,原料价格高企

- 资产折旧 建筑物:摊平二十年,一年比以前多RM 2mil ,至于机械则为10年