Highlight of 2019 Annual Report

- Overall, business across all sectors posted a positive growth in 2019 except gaming sector with a decrease of RM103 million / 0.01% due to reduction in incentives offered to the players as part of the cost rationalisation initiatives.

- Its EBITA margin dropped from 31% to 27% in 2019 in Malaysia mainly because of the increase in casino duty. However, overall business remain intact with EBITA of RM2554 million in 2019 despite higher casino duty while revenue grew by 6.6%.

- Number of visitors that visited Genting Highland were record high at 28.7 millions visitor in 2019.

Concern of Genm moving forward

- Share of result in associate (Empire Resort): In 2019 Q4, Genm recognize a loss of RM31.6 million from Empire Resort (Assuming if Empire Resort posted the same losses per quarter, RM31.6 x 4 = RM126.4 million in 2020)

- Rising of finance cost and its gearing ratio:

- 2017: Finance cost = RM115 million, Gearing ratio = 0.05 times

- 2018: Finance cost = RM156 million, Gearing ratio = 0.09 times

- 2019: Finance cost = RM250 million, Gearing ratio = 0.19 times

- Nonetheless, its balance sheet remain strong with cash of RM6,529 million, Net Operating cash flow of RM2,577 million, borrowings due in less than 1 year amounting RM1,524 million and administrative expenses of RM780 million.

- Suspended operations at RWG, Resorts World Awana, Resorts World Kijal and Resorts World Langkawi since 18 March 2020 in compliance with the Movement Control Order announced by the Prime Minister. Similarly, as required by the respective authorities, RWNYC, RWC, RW Bimini, Resorts World Birmingham and the Group’s other land-based casinos in the UK are also temporarily closed to curb the spread of COVID-19.

Future Prospect

Malaysia:

- Opening of theme-park will be further delayed until Q4 2021.

- Rebranded online business as ‘GentingBet’ in addition to launching a new website with exclusive content.

- Embarked on vertical integration in the online gaming space by acquiring Authentic Gaming Limited (“Authentic Gaming”), an online gaming specialist, to expand the Group’s offering through the utilisation of Authentic Gaming’s innovative streaming technologies to bring together its offline and online gaming experiences.

- Resorts World Casino New York City (“RWNYC”) maintained its market leading position by gaming revenue in the Northeast US region and the expansion of 400 rooms hotel is expected to open in second half of 2020.

- Empire Resort gaming revenues registering a 33% increase in December 2019.

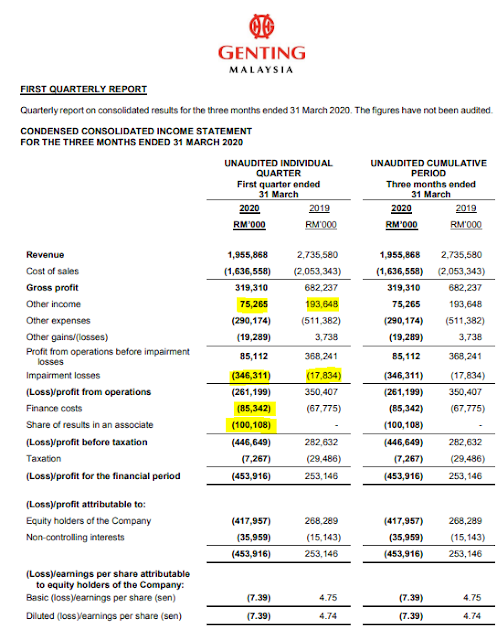

GENM Q1 2020

- Revenue was lower by 36% due to lockdown of 12 days in March.

- Lower other income recorded in Q1 2020 as there is one off disposal gain of UK subsidiary amounting RM124 million in Q1 2019.

- Higher impairment loss in Q1 2020 in view of the impact of Coronavirus Disease 2019 (“COVID19”) on the business activities, in accordance with MFRS 136 “Impairment of Assets”.

- An impairment loss of RM223.3 million relating to the assets of Resorts World Birmingham

- An impairment loss of RM56.5 million relating to certain casino licences and assets in the United Kingdom

- An impairment loss of RM66.5 million relating to the assets of Resorts World Bimini

- Finance cost continue to increase with higher borrowings. Gearing ratio increase from 0.19 to 0.25 in Q1 2020.

- Losses incurred were RM100 millions on Empire Resort mainly due to the share of costs associated with the refinancing of Empire’s loans.

- EBITA for Q1 2020 were RM355 million as compared to RM684 mmillion in Q1 2019. A dropped of 48%.

Future Prospect

- Impact on Genm is very big as all its operation in Malaysia, US and UK were halted due to Covid 19.

- Losses on Empire Resort can be bigger than expected. If RM100 million x 4 = RM400 million which is equivalent to 30% of 2019 net profit.

Valuation of GENM at RM2.60

- In 2019, Revenue = RM10,406 million, EBITA = RM2,554 million, Share price = RM3.03

- As Genm operations in Malaysia unable to operate from 18 March 2020 - 31 August 2020 which is approximately 6 months. Lets discount its earnings and share price by half + an additional 15% for consumer sentiment to pick up. If discounting share price by 50%, Genm should worth RM1.50, if discounting share price by 65%, Genm should worth RM1.1. So RM1.1 - RM1.5 should serve as the rock bottom price for Genm to factor in the full impact of covid 19 on Genm financial.

- I do not expect Genm to pay any special dividend in 2020, assuming a 50% dividend cut on its interim and final dividend, Genm will pay a total of 5.5 sen. At the price of RM2.6, its DY is 2.1%

- Market is always irrational. Any price that we buy into above RM 1.1 - RM1.5, we would need to ensure that we have sufficient money to average down if necessary.

No comments:

Post a Comment