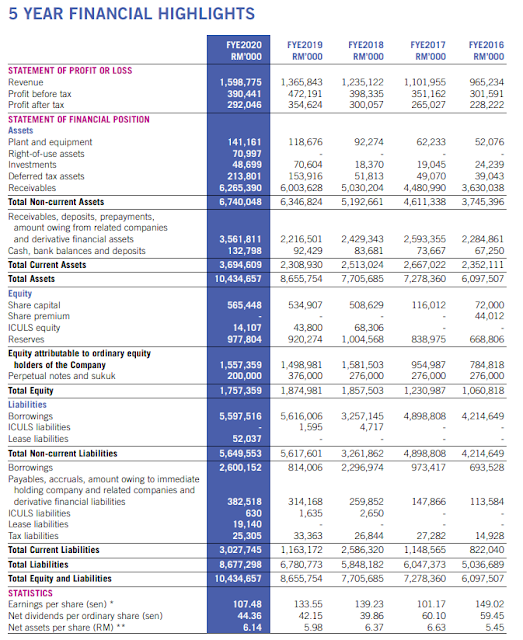

- Revenue increased by 17% with financing receivables increased by 19%.

- Net profit dropped by 17% due to higher impairment loss on financing receivables. In 2020, Aeoncr recognized an additional RM142 million of impairment as compared to 2019.

- Operating profit before working capital changes were actually higher in 2020 at RM 1228 million compared to RM 1068 million in 2019.

- NPL stood at 1.92% for 2020.

- Drop in dividend per share in 2020 is due to lower EPS caused by higher impairment loss. Dividend payout ratio remain the same as 2019 which is approximately 34%.

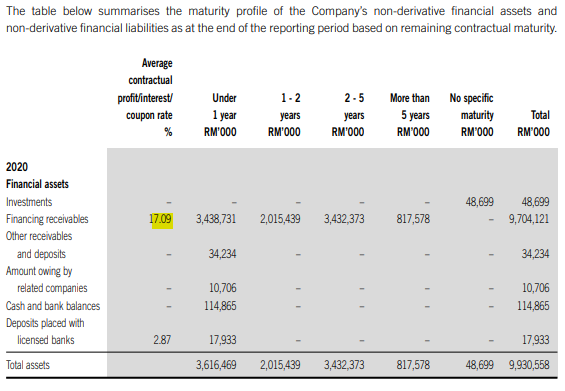

- On average, Aeoncr is charging 17.09% of interest to their borrowers.

- However, Aeoncr only paid an average of 3% - 4.5% of interest to the bank to secure their fund.

- 2.5% of their finance receivable portfolio failed to pay their loan within 30 days (Stage 1).

- 1.7% of their finance receivable portfolio failed to pay their loan within 90 days (Stage 2).

- 2.3% of their finance receivable portfolio failed to pay their loan for over 90 days (Stage 3).

- Non Performing Loan for Aeoncr in 2020 is 1.92% meaning to say they are still able to collect 20% of their money back under Stage 3 customers.

- Revenue contributed by each segment from 2018 - 2019

Future Prospect

- GDP growth for Malaysia in 2021 expected to be 0.5% to -2%.

- Focus on three strategic business drivers: digitization, regionalisation and operational efficiency.

- Leveraging on FinTech, AEON Credit aims to progressively transition to a lower-cost business model. Offering retail financing solutions online is the future for AEON Credit, similar to other financial service providers.

- Through digitization, the Company is looking at tapping into the rural and semi rural market.

Valuation of Aeoncr at RM10

- Average PE of Aeoncr from 2015 - 2020 is 9.5 times. At the price of RM10, its PE is 9.3 which is below its average PE.

- Aeoncr paid a dividend of 36 sen in 2020 which translate into 3.6% at the price of RM10. Historically its DY is always around 3% or below hence a 3.6% yield is consider above its average.

- Price to book value is now 1.45 times which is above its average of 1.11 times.

- In 2020, its EPS shrink 21% as compared to 2019 however its share price shrink 45% which means the price drop is greater than its drop in earning.

- Assuming a 20% drop in EPS in 2021, at PE 9.5, Aeoncr is worth RM8.2 (9.5 x 86 sen).

- Assuming a 10% drop in EPS in 2021, at PE9.5, Aeoncr is worth RM9.2 (9.5 x 97sen).

hi do you mind showing me how to calculate the percentage for finance receivable portfolio failed to pay their loan? I tried to calculate myself but not able to get so.

ReplyDelete