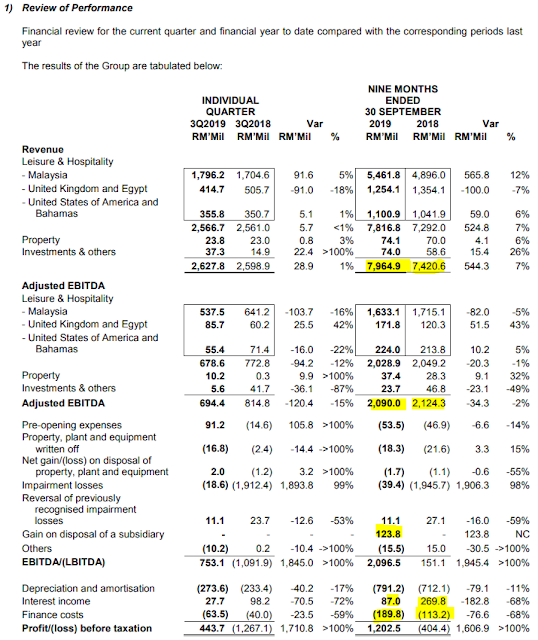

- Genm's revenue increased by 7% to RM7.9 billion with both Malaysia and US increased 12% and 6% respectively while UK revenue dropped by 7%

- Malaysia - the overall business volume from gaming segment declined in YTD Sept 2019 due to reduction in incentives offered to the players. The non-gaming segment revenue has increased by 36%.

- US & Bahamas - due to the strengthening of USD against RM. Excluding this impact, revenue would have increased by 2% mainly due to higher volume of business from RWNYC operations.

- UK & Egypt - due to lower hold percentage from its premium gaming segment in UK and lower revenue from Cairo, Egypt.

- However its EBITA dropped by 2% mainly dragged by businesses in Malaysia due to higher casino duty. However if you look at its EBITA margin as compared to 2017 & 2018, the EBITA margin actually maintains.

- There is a disposal gain of RM123 million from the disposal of a subsidiary in UK.

- Lower interest income received in 2019 is due to impairment of the Group’s investment in the promissory notes issued by the Tribe in 2018.

- Finance cost increased by RM76 million due to lower qualifying assets eligible for interest capitalisation during the period and there is an increase in bank borrowings.

- Cash at bank reduced 11.2% and bank borrowings increased 1.9% (Its gearing ratio increased to 16% from 9%.)

- The management mentioned that the outlook for gaming business remain challenging.

- Outdoor theme park expected to open on time which is Q3 2020.

- Genm acquire LeoVegas Mobile Gaming Group's subsidiary Authentic Gaming for RM70 million to strengthen its footprint for online gambling in UK.

- Resort world NYC is still under expansion to maintain its market leader position in northeast US region. Starting 2020, RW catskill will start to contribute its revenue and losses.

Comments:

- Overall speaking, Genm has reported a higher revenue with a stagnant profit which is considered as good (However its EBITA margin remain competitive which its there is no issue with its core operation).

- However its gearing ratio increase from 15% from the previous quarter to 16% this quarter. Genm has a series of acquisition on UK Authentic Gaming and US Empire Resort which might prevent it from giving special dividend this year (This is the risk).

- At current price of RM3.11 its PE is only 12.60. With PE 18, its share price will be RM4.44. If there is no special dividend, at RM3.11 a share, a dividend payout of 11 sen will be 3.5%.

No comments:

Post a Comment