Corporate Profile

- FPI is a sound system manufacturer with 30 years of experiences specialized in original equipment manufacturing (OEM) services including woodworking, plastic injection, driver units, PCB assembly and finished-products assembly as well as Original Design Manufacturing ("ODM") services. (OEM means FPI make devices from components parts bought from other company; ODM means FPI designs and manufactures a product, as specified, that is eventually rebranded by another firm for sale). However, FPI is still mainly in OEM business as they have dispose their ODM business of Acoustic Energy.

- FPI used to be an audio system and components manufacturer however diversified into musical instrument segment in 2014.

- FPI products and services:

- Products

|

| a. Musical Instrument Product: FPI clients include Roland, Casio, Korg etc. Roland contributes 80% of revenue to the musical instrument segment. |

|

| b. Wireless Speaker Product: FPI clients include Sony, Panasonic, Bose, Sharp etc. Sony being their single largest customer. |

|

| c. Conventional Speaker Product such as home audio, speaker unit, plastic injection etc |

- Services:

- FPI derives its sales from Malaysia only after disposing its business in the UK (Acoustic Energy)

- 64% of FPI sales are contributed by 2 single customers. Meaning to say if the sales of these 2 clients dropped, it will greatly affect FPI's performance.

- According to HLIB report, as at 2017, 22% of sales were from musical instrument segment while the 78% were from audio system and components (The management indicated that in 2018 AR, musical instrument segment continues to grow however the audio system and components business dropped in term of quantity delivered. Nevertheless, the sales increased. Details were not provided by the management). Suspect that Roland is customer B as if 25% of revenue were from musical instrument segment and Sony for Customer A according to article from Insider Asia.

- FPI currently has 2 manufacturing side, one in Port Klang, selangor and another one in Sungai Petani, Kedah (Production capacity remain unknow as no information was provided by the management).

- Based on its revenue, FPI experienced a drop in sales since 2013 and recovered in 2017(This is because FPI sales is highly dependent on 2 of its major clients)

- Gross profit margin is in the range of 7% to 13%.

- Net profit margin is in the range of 4% to 8% (We will do a net profit margin comparison with other EMS companies in Malaysia later)

- Dividend payout ratio is in the range of 50% - 80% which is consider high.

- FPI is a net cash company with no bank borrowings. Net cash per share is 68sen.

- FPI has strong operating cash flow over the years and always generate free cash flow (meaning to said FPI is able to do consistent high dividend payout)

- Impairment on trade receivables only constitutes 0.02% of its total trade receivables (meaning every RM100 of sales, only RM0.20 unable to recover)

- FPI will greatly affected by USD because:

- 30% of its cash is in USD

- 36% of its trade receivables are collected in term of USD

- 23% of its trade payables are paid in term of USD

- Hence the strengthening of USD by 3% will lead FPI to have an forex gain of RM900k

- Increase in minimum wage and foreign levy for foreign labor will greatly affect FPI as 75% of its employees are foreign labor. (currently the minimum wage for foreign labor is RM1100)

- 2018: 2529 out of 3331 (75%) workers are foreign labor.

- 2017: 1568 out of 2257 (69%) workers are foreign labor.

- Employees expenses increased tremendously by 54% or RM36 million mainly due to increase in number of employees (increased by 47%). Revenue increased by 22% only. (Increase in number of employees is due to the additional factory used by Roland)

- FPI spend about RM1.7 million on R&D in 2018 which accounts 5% of its net profit.

Financial Highlight

Future Prospects

- Not too much is being mentioned in the annual report:

- Improvements across all its operations, including manufacturing, logistics, and quality systems.

- Invested substantially in new injection machines, CNC machines and some automated machines.

- Work cells or Work Stations have also been reconfigured to reduce flow times and to eliminate Work-In-Process (“WIP”) within the production line

- Elimination of non-value-added activities to the production process.

- In December 2018, the new factory has commence operation with a 20% increase in production capacity to cater the new contracts received from Roland. 70% of the additional capacity will be taken up by Roland. According to HLIB report, Roland might shift some of its China and Indonesia operations over to Malaysia.

- FPI only diversified into musical instrument segment in 2014 and this segment is still growing with Roland contributes 80% of musical instrument revenue (曾經在日本上市的Roland公司,目前在歐洲擁有約30%市佔率,其樂器主打專業人士市場,且品牌口碑和信譽良好。」值得一提的是, Roland公司此前只在印尼和中國的2家廠房以聯營方式生產樂器配件,因此對於海外業務的控制權有限。直到2014年, Roland才于大馬以獨資形式,設立海外的第3間廠房,并獲得了大馬投資發展局(MIDA)提供的「主要樞紐」(Principal Hub)的稅務優惠和福利。Roland公司已在我國做好了中長期部署,有意重點發展大馬業務,該公司發言人曾表示,將視大馬為繼日本之外第2個總部。大馬的廠房除了擁有所有股權,且政府也提供了多項津貼和獎掖,該公司料將原先于印尼和中國生產的配件,轉移到大馬生產,以降低生產成本。」)

- FPI acquire a piece of land (20 acres) besides Wistron which believes would be used to built factory to cater orders for Wistron (starting to do speaker sales to Wistron Group in 2019).

- Benefits from trade war if those MNC shift their orders to south east asia.

Strength

- Strong balance sheet with a net cash per share of 62 sen.

- Strong in generating free cash flow as proven over the years where FPI has the capability to distribute high dividend.

- Low impairment on trade receivables which means FPI is able to convert 99.8% of their sales into cash.

- Partnership with its major shareholder - Wistron Group which is a supplier of Apple, Dell, HP etc (starting to do speaker sales to Wistron Group in 2019).

- FPI do not require heavy capital expenditure to do business.

Weakness

- FPI is too heavily depends on individual customer as 65% of their sales were from 2 customers only. A reduction of their customer order will cause a huge impact on FPI's financial.

- Lack of automation in its production process. FPI is heavily dependent on foreign labor where 75% of their employees are foreign labor. Increase in minimum wage and foreign levy will affect FPI operating cost.

- Feels like the material cost of FPI fluctuate a fair bit by looking at its gross profit margin however it is still manageable(Gross Profit Margin for - 2015: 10%, 2016: 7%, 2017: 13%, 2018: 11%, 2019: 10%)

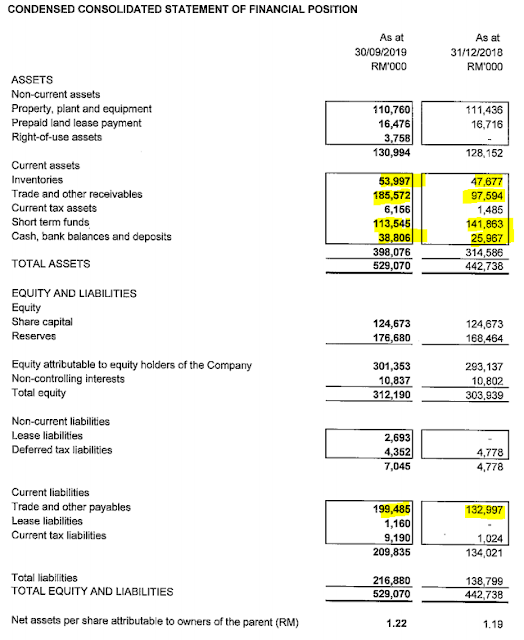

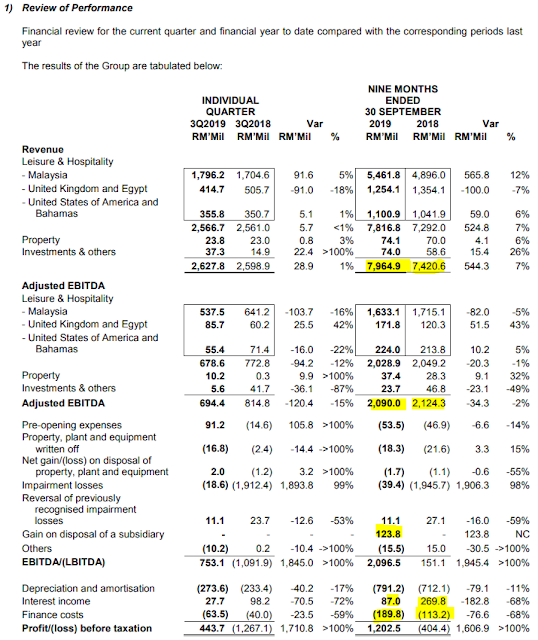

As at Q3 2019

- Revenue increased by 43% while distribution and administrative cost increased by 10% which is acceptable (i think increase in labor cost in 2018 was to prepare for 2019 contract orders)

- Increase in other income is mainly due to gain in forex.

- Increase in other expenses is mainly due to impairment loss on receivable of RM3.3 million.

- Inventories were higher by 13% which means the contract order remain high.

- Trade receivables increased by 100% however its sales merely increased by 43% (this means that debts recovery has taken longer than usual - suspect is from Wistron)

- Trade payable increase by 50%.

- Main reason for the increase in revenue was due to sales to Wistron which is its major shareholder (as you can see in 2018, FPI didnt sell any speaker to Wistron however RM142 million of sales was made through Wistron, which account for 25% of FPI revenue).

- The management remain cautious due to rising raw material cost and rising operating cost due to minimum wage policy.

Valuation at RM1.50

- Q3 usually serves as the strongest quarter for FPI.

- At the price of RM1.50, its current PE is only 9.64 which is close to its 5 years average PE of 9.44. A fair PE for EMS company would be 14. At PE 14, FPI is worth RM2.19. [Undervalue]

- At RM1.50 a share, its price to book value is 1.25. [Fair]

- FPI has a net cash of RM152 million however its market capital right now is only RM375 million. Meaning to say its cash on hand already constitute 40% of its market capital. [Undervalue]

- Assuming if FPI payout 11sen of dividend for 2019, at RM1.50 a share, its DY is 7.3% [Undervalue]