- Gross profit margin stood at 40% which is in line with their historical gross profit margin.

- Other operating income which is rental of construction equipment stood at RM 2.1 million which accounts 40% of 2018 other operating income (if exclude other operating income, its PBT on Q1 2019 will be RM 6.6 million vs PBT on Q1 2018 of RM 5.1 million, an increment of 29%)

- Admin expenses increased by 13% while revenue increased by 9% (i think the main reason for general & admin expenses to increase is due to higher depreciation, as depreciation increased by RM 0.5 million as compared to previous quarter)

- Finance cost accounts for 21% of its PBT which is maintaining at a healthy level.

- PBT improved by 53% if compared quarter to quarter however PAT remain flat as there is an income tax expense of RM 311k as compared to a tax credit of RM 2.7 million in Q1 2018 (if exclude the income tax, the company actually perform hell lot better in Q12019)

- Cash increased by RM 10 million or 34% in 2019 (thanks to its strong operating cash flow of RM 20 million VS lower amount spend on investing which is only RM 7 million).

- Borrowings remain approximately the same which is RM 208 million however, its gearing ratio increased to 72% from 64%.

- Total asset increased by 4.2% however total liabilities increased by 7% (meaning its debts actually increased faster than its assets)

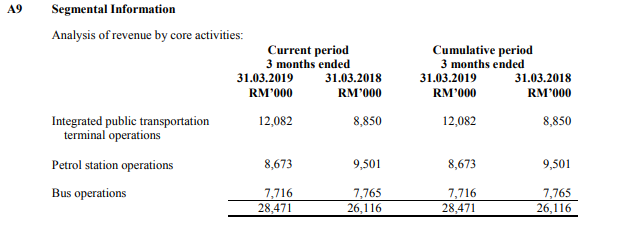

- IPTT operations shown have not include the earnings from Kampar terminal as the contribution will only starts kicking in during 2nd half of 2019 therefore, i expect its IPTT operations revenue to increase positively in 2019.

- Kampar Terminal will start operations in 2nd quarter of 2019 and expect to see contribution to come in in 2nd half of 2019.

- The management is positive with 2019 earnings.

Comments

- Although the EPS remain flat at 0.43 sen in this Quarter, however this is mainly due to:-

- Lack of tax incentive to offset its tax in this quarter as mentioned above.

- Number of shares increased by 6%

- Exclude the above incident, Ptrans actually perform a lot better as its PBT improved by 53% (if exclude its other operating income, PBT improved by 29%).

- Ptrans proofs to have a solid cash flow where it manage to generates RM 20 million of positive operating cash flow in Q1 2019 as compared to a total of RM 27 million of operating cash flow being generated in 2018.

- Moving forward, if the amount to reinvest starting to reduce, i believe Ptrans is able to slowly pair down its debts to reduce its interest expenses. This will definitely assist to boost its earning moving forward.

- Management is positive with its 2019 performance and contribution from Terminal Kampar is coming in in 2nd half of 2019. Terminal Kampar is 8 times bigger than its Amanjaya terminal.

- The risk moving forward i would say is additional expenses incurred for its Terminal kampar or the cost of running for Terminal Kampar is higher than expected which could dampen its earnings.

- At current price of RM 0.195, its PE is 7.77 which is way below its ROE of 12.4. Assuming that Ptrans maintains its EPS at 0.6 sen per quarter, with 35% dividend payout ratio, its dividend will be 0.84 sen for 2019. At current price of RM 0.195, its DY is around 4.3%.

No comments:

Post a Comment