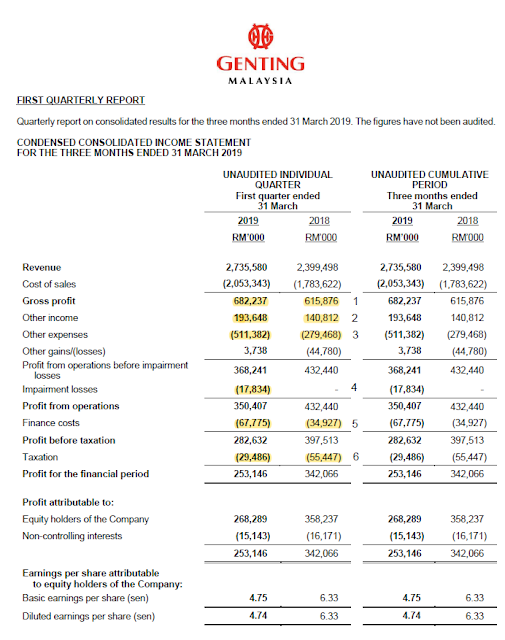

- Gross profit margin stood at 24.93% which is slightly lower than its 2018 gross profit margin of 26.82%.

- Other income stood at RM 193 million in Q1 2019 which accounts 40% of 2018 other income of RM 483 million mainly due to recognition of a gain of RM 123.8 million from the disposal of a subsidiary in UK.

- Other expenses increased by 83% mainly due to provision of related costs as a result of the termination of contracts related to the outdoor theme park at Resorts World Genting of RM 198.3 million.

- Genm incurred an impairment loss of RM 17 million in Q1 2019 which is quite normal as in 2017 Genm has an impairment loss of RM 54 million.

- Finance cost accounts for 26% of Genm net profit which is still manageable and their gearing ratio is currently 10% as compared to 9% in 2018. However, prior to 2017, Genm is a net cash company.

- The effective tax rate of the Group for the current quarter ended 31 March 2019 is lower than the statutory tax rate mainly due to tax incentives and income not subject to tax, offset by non-deductible expenses.

- The revenue in Malaysia grew positively by 12% as compared to Q4 2018. However, the management mentioned that overall business volume from gaming segment declined during the quarter due to reduction in incentives offered to the players as part of the cost rationalization initiatives.

- EBITDA in Malaysia is actually higher in Q1 2019 and i would said that the business is actually consider pretty stable.

- PBT for Q1 2019 is lower mainly due to one off expenses of pre opening expenses and lower interest income receive during the quarter.

- Same as before, Genm strategy is to maximize its operating cost structure to mitigate the tax rate hike.

Comment

- Genm achieved highest revenue recorded in a single quarter proving that Genting is still one of the most popular vacation destination for Malaysian and tourists.

- As mentioned above, the drop in PBT is mainly due to one off pre opening expenses of RM 210 million and one off gain of disposal of RM 123 million. If exclude these one off income and expenses, Genm actually achieve a PBT of RM 369.4 million which is in line with their previous earnings.

- It seems like the tax rate hike didnt really hurt the company earnings in this quarter as there is tax incentive to cushion it.

- I personally think that the worst for Genm is over as the 2 main uncertainties or concerns have been proved invalid which are the tax rate hike might dampen Genm's earning (seems like Genm core earnings is still growing) and impairment on theme park (has already reflect in current quarter).

- Assuming that if the company is able to generate a EPS of 5 sen per quarter, at PE 17, Genm is worth RM 3.40. Genm payout 80% of its profit as dividend in 2017 & 2018, assume a same dividend payout ratio, Genm would payout 15 sen of dividend for 2019. At the current price of RM 3.09, its dividend yield is 4.8%.

No comments:

Post a Comment