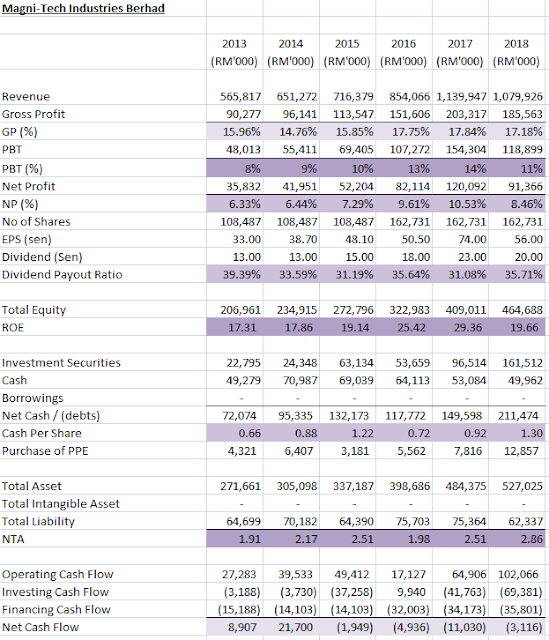

1) Note 9/page 91 of 2018 annual report (taxation) - the company have a reinvestment allowance of approximately RM 10 million to offset against its income tax in 2018, may i know how many years does the reinvestment allowance last? Can the company deliver a double digit growth moving forward once the reinvestment allowance is fully utilized?

- Based on the annual report page 90, the estimated unutilised investment allowances is RM138,223,491. Our company is allowed to claim up to 60% of the capital expenditure invested to be offset against 70% of its statutory income until year 2020.

2) Note6/page 88 of 2018 annual report (other operating income) - the company has an additional RM 3.5 million of rental income received during the year as compared to 2017. May i know where does the rental income derive from? Is that rental income sustainable moving forward?

- Our company owned some construction equipment like tower crane, forklift, main pump n etc. The rental income is mainly consist of the rental of those construction equipments.

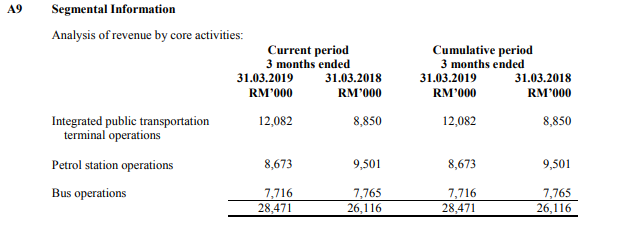

3) Note 30/page 116 of 2018 annual report (segment information) - the company's public transport operation segment incurred a loss of RM 32,000 during the year as compared to year 2016 and 2017 where the profit margin for public transport operation is 15% and 8% respectively. May i know what is the reason for the public transport operation segment to make a loss when Perak Transit Berhad dominate 97% of the bus transport business in Perak? May i also know what is the main reason for the profit margin of public transport operation to decrease from 15% to 8% and incur a loss in 2018?

- The losses recorded in the bus operation is mainly due to the accumulated one-off charges by APAD due to the instability of the Electronic Ticketing Machine. We are negotiating these charges with the authority. These charges would need to be provided for in year 2018 due to the accounting standard.

4) Note 17/page 102 of 2018 annual report (trade receivable) - the company's trade receivable increased by approximately 80% however its revenue merely increased 7%. May i know what is the main reason for trade receivable of Perak Transit Berhad to increase exponentially in 2018? Is it due to the deposit collection for its Kampar Terminal? if otherwise, please advice.

- The increase in the trade receivables are mainly due to the increase in revenue, the extension of the credit period and the biling towards the end of the month.

5) From my understanding that the income from integrated public transport terminal operation consist of rental of A&P spaces, rental of shop & kiosk, bus & taxi entrance fee collection, parking fee collection and project facilitation fee. Can you please explain what is project facilitation fee and how does it work? How much does it contributes to IPTT operations?

- Project facilitation fee is the fee paid to provide consulting services in relation to bus terminal development and operations to prospective clients.

6) Phase 1 of Kampar Terminal is expecting to operate in 2nd half of 2019. Based on your company projection, how much start up cost will incur to get Kampar Terminal up and run?

- Sorry to inform that we are not allowed to disclose the projected figures.

7) From my understanding there is a mall and hotel attached to Kampar Terminal. May i know what is the tenancy take up rate for the mall of Kampar Terminal up to date?

- Sorry to inform that we are not allowed to disclose the projected figures.

8) How much revenue and profit does Perak Transit Berhad project to generate from Kampar Terminal once it is fully operates?

- Sorry to inform that we are not allowed to disclose the projected figures.

9) What is the competitive advantage of Kampar Terminal and how does it compliment its Amanjaya Terminal?

- Terminal Kampar Putra is located in a University town. There is no supermarket in Kampar and its surrounding towns. We are offering a lifestyle hub to the students and residents in Kampar and its surrounding towns.