- First company that breach RM 100 billion in market capital in Malaysia

- 48% owned by PNB and its fund, 12% by EPF and 19% by foreign fund.

- Maybank is presence in 18 countries with 2,601 retail branches with Malaysia, Singapore and Indonesia as its main market.

- Malaysia contributes 70.1% of its PBT followed by Singapore 12.2% and Indonesia 6.9%. (overseas contribution of PBT is 29.9%)

- Maybank business are divided into 4 categories:

- Islamic Banking

- Leading provider of Islamic financial product and services in ASEAN

- Domestic market leader in total asset, total financing and total funding

- Contribute 59% to Maybank's financing in Malaysia

- Etiqa

- Offering full range of life & general conventional insurance policies as well as family & general takaful plan

- Etiqa is presence in Malaysia, Singapore, Philippines & Indonesia with over 8100 agents, 46 branches and 17 offices.

- Maybank Kim Eng Group

- Invesment arm of Maybank Group namely Maybank Investment Bank (focus on operation in Malaysia) and Maybank Kim Eng (focus on overseas operation).

- Maybank Kim Eng has operation in 9 countries namely Singapore, Thailand, Philippines, Indonesia, Vietnam, Hong Kong and US with a total of 155 retail branches globally

- Maybank Asset Management

- Currently has RM 26 billion of assets under the management

- 47.5% of PBT are from community financial services, 45.7% of PBT are from global banking while 6.8% of PBT are from islamic insurance (Etiqa).

- 4th largest bank by total asset in ASEAN

- 6th largest bank in term of market capital.

Financial Performance

- Interest income and net interest income grew at CAGR of 5.38% & 4.47% respectively from 2014 - 2015.

- Net interest margin remain stable at 2.3% - 2.4% throughout the 5 years.

- Income from islamic banking operation grew at CAGR of 11.4%.

- Etiqa insurance premium grew at CAGR of 8.5%.

- Total operating income and net profit income grew at CAGR of 4.9% and 3.87% respectively throughout the 5 years (which is in line with their interest income growth)

- Overheads to income ratio reduced by 1% to 39% in 2018.

- Its profit hitting the RM 8 billion benchmark for the first time.

- Net profit margin remain stable at approximately 30%.

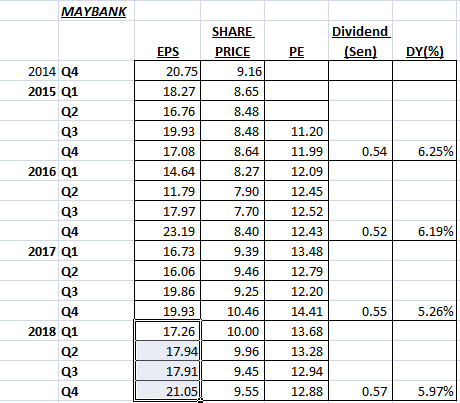

- Dividend payout ratio is at 75 - 77% (one of the most generous dividend payout company in the industry).

- Percentage of impairment losses on loan, advances and financing improved greatly to 13% in 2018.

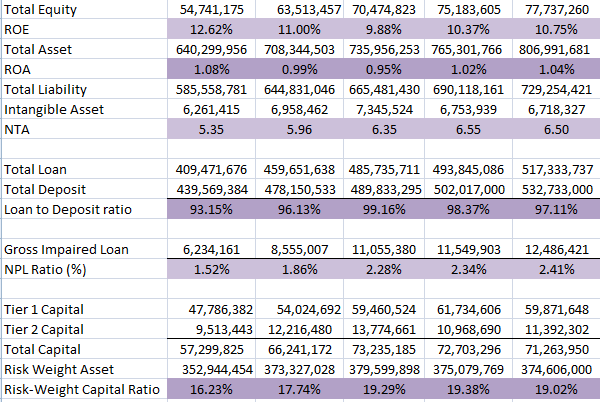

- ROE improved from 9.88% in 2016 to 10.75% in 2018.

- Total loan and deposit grew at CAGR of 4.79% & 3.92% respectively.

- Loan to deposit ratio for Maybank is on the high side where they use 98% of their deposit collected to borrow out to their clients.

- Non performing loan ratio increased from 1.52% in 2014 to 2.41% in 2018 (however 2.41% is still consider acceptable).

- Risk weight capital ratio is 19.02% which is well above the 8% set by bank negara.

Future Outlook

- Focus on digital banking by launching QRpay, form partnership with grab to increase the usage of cashless payment, implement E-CLEVA (real time video assistance claim for motor and fire insurance, allowing claims to be processed via video calls within 15 min), launched MAE.

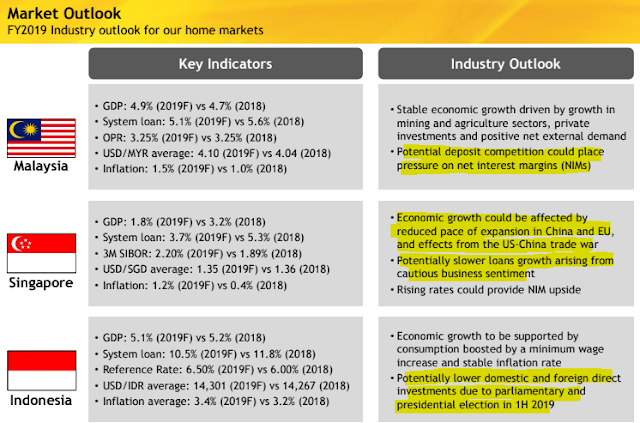

- Market outlook sounds competitive in its 3 main markets.

Strength

- Diversified business income (involved in islamic insurance where the business is growing exponentially with CAGR of 8.5% from 2014 - 2019)

- Generous with its dividend payout with 6% dividend yield which is highest amount the region.

- Stable earning

Weakness

- Finance industry remain to be challenging moving forward.

Valuation @ RM 9.27

- At RM 9.27 a share, PE for Maybank is 12.62 which is deemed fairly valued as its futures prospects seems challenging moving forward.

Technical Analysis

- Maybank is currently on a downtrend with the price trading below its moving average. The nearest support will be at 9.15, follow by 8.70 and 7.96.

No comments:

Post a Comment