- Fifth largest banking group by assets in ASEAN

- 3rd largest bank in Malaysia with market cap of RM 48 billion follow by Maybank (market cap: RM 102 billion) and PBBank (market cap: RM 88 billion)

- Presence in 16 countries with 796 retail branches and strengthen its presence in ASEAN markets by opening its first branch in Vietnam in 2016 and operates its banking business in Philippines in 2018.

- Malaysia and Indonesia accounts for 84% of their PBT and 57% of their PBT was from commercial and consumer banking

Analysis of Financial Statement

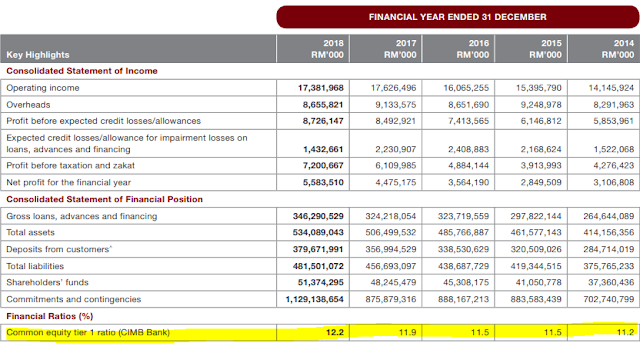

- The compound annual growth rate (CAGR) for interest income is 3.68% over the 5 years.

- Net interest margin decreased from 2.8% in 2014 to 2.5% in 2018 (CIMB can work harder on this).

- Income from Islamic banking operations grew at CAGR of 12.30%.

- Total income grew at CAGR of 4.21% over the five years, however, the total income in 2018 is actually RM 1,173 million lesser than 2017 if exclude the one off gain of RM 928 million.

- Net profit grew at CAGR of 12.27% with net profit margin improved greatly to 33% in 2018 (the improvement in net profit margin in 2018 is mainly due to RM 928 million on sale of CIMB-Principal Asset Management and 10% of CIMB-Principal Islamic Asset Management).

- Overheads to income ratio improved greatly from 59% in 2014 to 50% in 2018 (if exclude the one off gain of RM 928 million, the overheads to income ratio remain at 52% in 2018 which is the same as 2017)

- Dividend payout ratio remain at 40 - 50%.

- Percentage of impairment losses from loans, advances and financing improved to 16% in 2018 (this is some great improvement)

- Return of equity is around 10.77% in 2018, improved from 8.27% in 2014.

- CIMB total assets grew at CAGR of 5.22% over the 5 years.

- Return of asset is around 1.06% in 2018.

- Net tangible asset is currently RM 4.62 per share (if you bought CIMB at RM 5.11, RM4.62 out of the RM 5.11 you paid is actually asset)

- Gross loan and deposit grew at CAGR of 5.53% and 5.93% respectively.

- Loan to deposit ratio remain at a very healthy level of 90 - 95% over the 5 years.

- Non Performing Loan remain at around 3% (not much improvement on this and CIMB has the highest NPL in the industry, ).

- Risk weight capital ratio improved from 14% in 2014 to 17% in 2018 (CIMB is now stronger than before in term of the degree of protection of depositor's assets)

Future Plans

Before we look at CIMB futures plan, lets recap its 3 years financial target known as "T18" that was being announced in year 2015 and to achieve by year 2018.

T18 Initiatives:

- To be presence in all 10 ASEAN countries (achieved, managed to add Vietnam and Philippines onto their footprint)

- ROE of more than 15% (not achieved, however they improved their ROE from 6.86% in 2015 to 10.77% in 2018 )

- Cost to income ratio of less than 50% (consider achieved, as they improve their cost to income ratio from 60% down to 52%)

- Consumer banking to contribute approximately 60% of its income (not achieved however they improved from 43.21% in 2015 to 46.38% in 2018)

- Common equity tier 1 ratio of more than 11% (achieved, its CET1 ratio is 12.2% in 2018)

Overall, the company managed to strengthen their fundamental over the 3 years through its T18 initiatives. Now lets look at its next 5 years of blueprints known as "Forward23".

Forward23 - financial target to achieve by 2023:

- ROE of more than 12%

- Cost to income ratio of less than 45%

- Common equity tier 1 ratio of more than 13%

Forward 23 - non financial target to achieve by 2023:

- Customer experience, environmental, social & governance ranking and ratio of digitally skilled staff

Financial target for 2019:

Strength

- Presence in all 10 ASEAN countries.

- Successfully strengthen its foundation through its T18 initiatives (Risk weight capital ratio was highest at 17.83% over the five years)

Weakness

- None performing loan ratio of 2.91% to remain as the highest in the industry (PBB - 0.5%, Maybank - 2.41%, RHB - 2.06%, Ambank - 1.70%, BIMB - 0.93%)

- Interest income for 2018 is actually lower than 2017 (indicating the market remain challenging for CIMB)

Valuation @ RM 5.11

- At the price of RM 5.11, CIMB is currently trading at its lowest PE (PE 8.75) ever since 2014

- EPS at 2018 Q2 was higher at 21.29 sen due to a one off disposal gain of RM 928 million. If we took out the one off gain, the actual EPS for 2018 Q2 will be 11.29 sen. Therefore, the actual EPS for 2018 will be 49.67 sen.

- At RM 5.11 with EPS of 49.67 sen, the real PE for CIMB is 10.28 which is still the lowest since 2014.

- Dividend yield at RM 5.11 is 4.9% which is the highest since 2014.

PE Comparison Among Peers

PE

PBBank - 15.89

Maybank - 12.61

RHBank - 9.97

Ambank - 10.28

BIMB - 11.38

CIMB - 8.75

HLBank - 16.16

Affin Bank - 8.69

Allianz Bank - 11.84

Technical Analysis

CIMB is currently trading at its support of 5.10 follow by 4.93 and 4.72. Technical wise, CIMB is at its downtrend and there is no sign of rebound yet. However, there might be opportunity for value investors.

No comments:

Post a Comment