- Business segment are divided into:-

- Integrated public transportation terminal operations (rental of advertisement & promotional (A&P) spaces, rental of shops & kiosk, bus & taxi entrance fee, project facilitation fee)

- Bus operation

- Petrol station operation

- Listed on Ace Market in 2016 and transfer to Main Market in 2018 (may attract more sophisticated investor being on the main market).

- PTrans received Letter of Intent from SPAD on the appointment as network operator for the SBST programme for a period of 8 years since 2015 (5 more years to expiry however i think the chances for renewal are quite high).

Financial Highlight

- Increase in revenue from 2016 - 2018 is mainly due to higher project facilitation fee and revised upward of rental of A&P spaces in 2018. (the profit margin for project facilitation fees and A&P spaces are 80%)

- Gross profit margin and net profit margin for the company is relatively high at approximately 40% and 30% respectively as the main source of income for PTrans is from its terminal operations which is a bit similar to reit where the company just collect rental income.

- The higher operating income in 2018 is due to higher rental income received (however, i am not too sure where does the rental income from?)

- Administrative expenses increase by 27% however its revenue merely increased 7% (my guess on the increase of admin expenses is due to the increase of its depreciation cost, as depreciation increased by approximately 20% in 2018 due to completion of its Terminal Kampar )

- Finance cost is 23% of its net profit before tax which is considered fair and manageable.

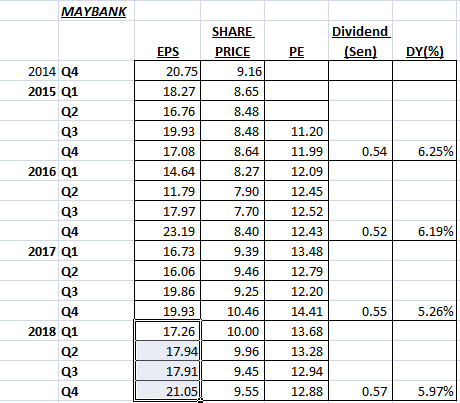

- The company's EPS managed to increase even though the number of shares increased.

- Dividend increased over the 3 years with dividend payout ratio of 30 - 40% (assuming the management will pay the same amount of dividend in 2019, at current price of RM 0.22 a share, the dividend yield is 4.7%)

- ROE > 10% (very well managed for a penny stock like this)

- Borrowings increased by 20%, however gearing remain at the same level of 65% thanks to the strong operating cash flow. (main reasons on increasing in borrowings is due to construction of Terminal Kampar and the expansion plan for Terminal Bidor and Terminal Tronor)

- As we can see that in 2018, its profit after tax (RM 36 million) is higher than its profit before tax (RM 32 million) because the company have reinvestment allowance (RM 9 million) and over provision of tax expenses in prior year (RM 2.5 million) to offset their income tax. Even in year 2017, the tax paid is only 5% of its PBT due to the reinvestment allowance (I am not too sure how long can the reinvestment allowance last for the company to enjoy such low tax rate)

- The company has a capital grant of RM 10 million from the government on construction of integrated public transport terminal which is to be claimed over 50 years (this is kind of insignificant as it only translate into approximately RM 200k per year which is only 0.6% of its PBT)

- Trade receivable increased by 80% however its revenue only increased by 6% (however on the bright side, there is no impairment being made)

- Integrated public transport terminal operations (IPTT) contribute 40% of its revenue, followed by petrol station operation of 38% and public transport operation of 22%.

- Integrated public transport terminal operations contribute 97% of its profit before tax and the remaining was contributed by its petrol station operation. Public transport operations made a losses of RM 32,000 in 2018 (not too sure what is the reasons for the loss)

- Profit before tax margin for IPTT operations was 77% and petrol station operation was 2.5%. However in 2016 & 2017, profit before tax margin for public transport operation is 15% and 8% respectively.

Futures Prospect

- Kampar Terminal to operate in 2019 (Terminal Kampar is 8 times of the size of its existing Amanjaya Terminal, there is also a mall and 12 storey hotel attached to Terminal Kampar)

- Terminal Kampar is near to kampar hospital, UTAR and Kolej Tar with 28,000 student population.

- Amanjaya Phase 2 in the pipeline after Kampar Terminal (There is a land besides Amanjaya Terminal which is used as a holding bay right now with the size of 135,721sf).

- Plans to construct Bidor Terminal and Tronor Terminal (still at preliminary stage however the deposit for acquisition the land for Bidor Terminal has been paid)

Strength

- Management is willing to share its profit with the shareholders with dividend payout ratio of approximately 35% which is more than the company policy of 25% dividend payout (it is quite rare for a penny stock like this to be generous with dividend payout)

- PTrans is more like a real estate investment company where 97% of its profit is generated from its terminal operation such as collecting rental, advertisement and promotional space rental & terminal facility fees collection. This recurring income are relatively stable.

- PTrans competitive advantage:-

- 1st: Terminal Amanjaya is the only gazetted express bus terminal in Ipoh (monopoly business)

- 2nd: Operates in industry with barriers to entry

- 3rd: All express buses are mandated to pick up and drop off passengers at the Amanjaya Terminal

- 4th: Controlling 97% market share of bus operation in Ipoh

- Bus terminal operations business will not affected by the economic cycle as the demand will always be there.

Weakness

- Its bus operation business made losses in 2018.

- Petrol station operation margin is relatively low at 2.5% (however, this is not a major issue as this segment only contribute 3% of its PBT)

- Tax rate hike when the reinvestment allowance was being fully utilized hence lower its net profit.

- Risk of further increase in borrowings and gearing to build Bidor Terminal and Tronoh Terminal thus dampen its cash flow (however if Kampar Terminal start operating in 2019, i believe the cash flow from operating for PTrans will further strengthen).

- Higher depreciation will incur when Terminal Kampar starts operating. (If the income generated from Terminal Kampar is enough to mitigate the depreciation cost, then this wont be an issue)

- Higher Interest expenses will incur for constructing Bidor and Tronor Terminal (like i mentioned, if the recurring income from Amanjaya and Kampar Terminal are stable enough, this wont be an issue)

- Start up cost to run Terminal Kampar.

- Dividend payout is currently based on its borrowing.

- Its earning is heavily depends on Amanjaya Terminal (if anything happened to the terminal, things will look ugly)

Valuation @ RM 0.22

- Dividend yield at RM 0.22 is 4.7%.

- ROE of PTrans is 11.5, therefore i think a fair PE for PTrans would be somewhere around 11 - 12. At current price of RM 0.22, its PE is only 8.2. At PE of 11.5, its share price is RM 0.31.

- If the contribution of Kampar Terminal kicks in during 2019, EPS 🔺 & PE will 🔻

- Question to ponder: Can Terminal Kampar at least double up PTrans revenue and profit when it is fully operating in 2 years down the road?