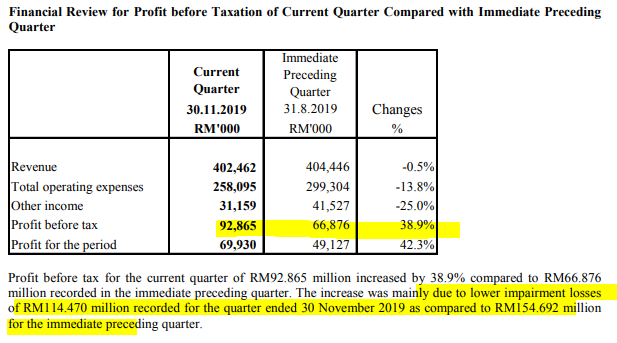

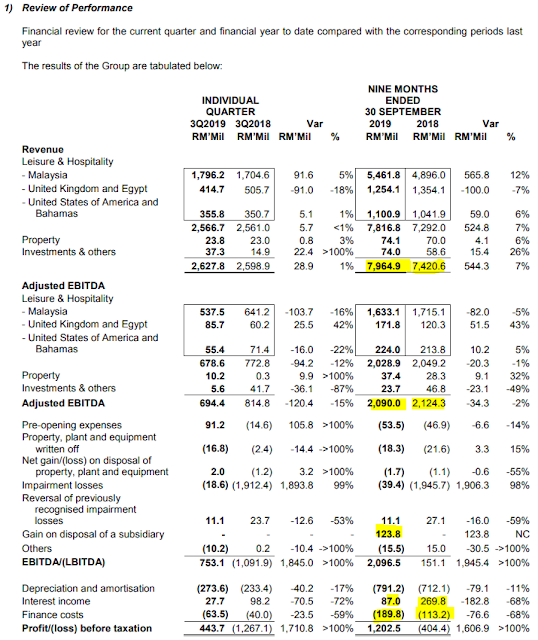

- Revenue for 9 months increased by 17.8% however its operating expenses increased by 36.6% which is 2 times more than its revenue (the increase of operating expenses is due to increase in allowance for impairment on receivables of RM148 millions. If excluding the the additional impairment of RM148 million, the actual increase of operating expenses would be 10.7% which is in line with the increase of its revenue [RM779m - RM148m = RM631m; RM631m - RM570m = RM61m; RM61m / RM570m = 10.7%]).

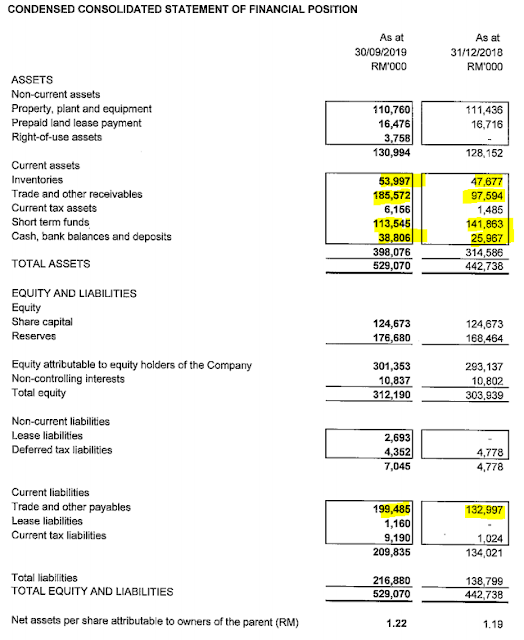

- Interest expenses increased by 29% which is in line with its increase in bank borrowing of 20%.

- If excluding the additional RM148 million of receivables impairment, Aeoncr would have achieve RM351 millions of net profit which is 31% higher than 2018.

- Revenue ⬆ 17%, net financing receivables ⬆ 15%, borrowings ⬆ 20% , total asset ⬆ 15% and total liability ⬆ 20% (the increase in net financing receivables is lower than its borrowings amount might due to higher impairment of receivables)

- Core operating profit before working capital improved to RM919 millions for the first 9 months. An increase of 17% which is identical to its revenue (meaning to say the fundamental of Aeoncr didnt change as the operating profit actually increase)

- The impairment of its receivables due to MFRS 9 has slows down in current quarter as compared to its last quarter (this could means that it is about time to collect Aeoncr)

- Future prospects remain to be the same as previous quarter by focusing on growing quality assets and enhance operating efficiency.

Comments

To conclude, Aeoncr did a great job where revenue increased by 17%. If excluding the additional RM148 million of impairment receivables (due to MFRS 9), Aeoncr is able to achieve RM351 million of net profits over the 9 months which is 30% higher than 2018. Core operating cash flow before working capital changes also increased by 17%. This has proven that the drop in net profit is just temporary and after 2019, Aeoncr might continue its growth legend.To add on, the impairment of receivables has started to slow down in Q3.

valuation wise, at RM 14.70 a share with EPS of RM1.0915, Aeoncr is trading at PE of 13.46 which is quite fair at the moment. Assuming if Aeoncr achieve an EPS of 30 sen next quarter, its full year EPS is 106 sen. At PE 11, Aeoncr is worth RM11.66.

At RM14.70 with 45sen of dividend distribution, its DY is only 3%