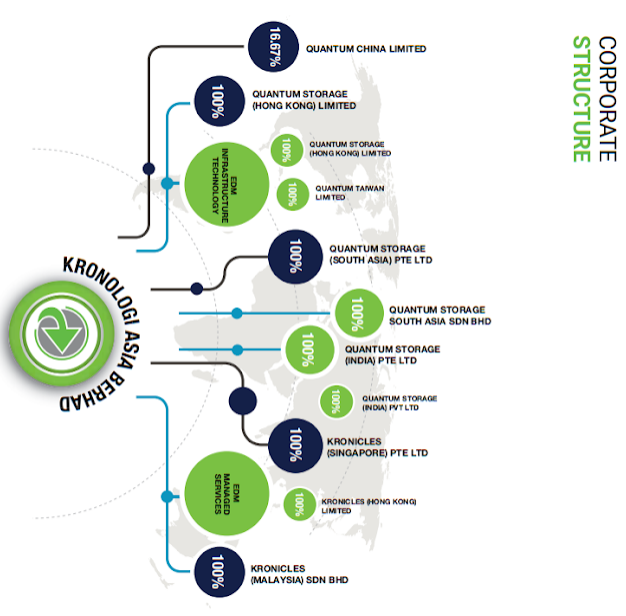

- Krono is specialized in Enterprise Data Management (EDM) of Information Technology (IT) and Managed Services (MS). (In short, Krono is providing cloud services and other data management services)

- IT segment contributes 94% / RM 153 million of the group revenue.

- MS segment contributes 6% / RM 10 million of the group revenue.

- Milestone of Krono

- 2014 - Listed on Bursa Malaysia (Revenue: RM54 million ; Net profit: RM6 million)

- 2016 - Acquire the remaining 80% of Quantum Storage (India) Pvt Ltd for RM26 million with a profit warranty of USD1 million / RM4.2 million per year. (Revenue increased by 48% to RM 81 million while net profit increased 18% to RM7 million)

- 2017 - Private placement to raise RM22 million. The money raised were used as below:

- 2017 - Acquire 100% Quantum Storage (Hong Kong) Limited for RM45 million with a profit warranty of USD1.2 million / RM5 million per year (Revenue increased by 77% to RM144 million while net profit increased 68% to RM12 million).

- 2018 - Private placement to raise RM23 million. The money raised were used as below:

- 2018 - Acquire 16.67% of Quantum China Limited for RM12.5 million (Revenue increased by 12% while net profit increased by 34%)

- 2019 - Acquire 100% Sandz Solutions for RM75 million (Sandz provides IT infrastructure solutions services in the Philippines through its subsidiary Sandz Solutions Philippines Inc. The planned acquisition comes with a warranty from the vendors that Sandz would achieve a profit after tax of US$1.5 million (RM6.11 million) for FY19.)

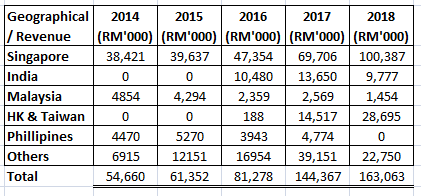

- Singapore remain as Krono major market with 61% followed by Hong Kong and Taiwan (17%) and Malaysia only contributes 0.9% of Krono's revenue.

- From the information below, we can witness that the acquisition of Quantum Storage (Hong Kong) Limited has greatly increase it presence in HK and Taiwan where revenue improve from RM188k in 2016 to RM 28 million in 2018.

- In 2016, Krono acquire Quantum Storage (India) Pvt Ltd which give Krono the opportunity to enter the Indian Market. However from the revenue generated, it is obvious that the market in India is unstable as the revenue fluctuated.

- In 2019, Krono acquire Sandz Solution to strengthen its footprint in Philippines (This is proven that the revenue from Philippines increased to RM41 million in 3 quarters).

- Questions for the management, why is it that corporate in Malaysia do not use cloud service? or they do just that they are using its competitors services? As its business in malaysia shrink from 2014 to 2018.

Financial Highlight

- With a series of acquisition since 2016, Krono revenue increased 100% from RM81 million in 2016 to RM163 million in 2018.

- Gross profit margin is around 20% - 25% while net profit margin is around 8% to 10%.

- Krono distributed a final dividend of 2sen for the first time in 2018 which accounts for 45% dividend payout ratio. However based on its cash flow and cash status i doubt there will be a dividend payout this year.

- Although there is an increase in number of shares however the increase of shares do not actually diluted its earnings per share. Meaning to say that its acquisition actually helps to increase the shareholder values.

- Krono spend the most money in purchasing PPE in 2019 (But i am not too sure what kind of PPE are they)

- One thing that we need to take note is that Krono's goodwill accounts for 31% of its total assets in year 2019.

- Cash flow remain tight and chances for it to distribute dividend is low however it is still posible for the management to do so as it is still in net cash position as at Q3 2019.

- In 2018, there are 2 major customers, with customer B contributes 20% and customer C contributes 18% to the group revenue (not sure what happened to customer A that it suddenly contributes less than 10% to the group's revenue).

- Currently the company income tax rate is approximately 4.2% due to income tax exemption and allowance (However please take note that its 100% tax exemption in Malaysia ended in 2020 and the 400% tax allowance in Singapore ended in 2018).

Futures Prospect

- Acquiring Sandz Solution in Philippines will further strengthen their footprint in Philippines.

- Sandz Solution promise a profit guarantee of USD1.5 million / RM6.15 million.

- Quantum Storage (India) Pvt Ltd promise a profit guarantee of USD1 million / RM4.1 million.

- Quantum Storage (Hong Kong) Limited promise a profit guarantee of USD1.2 million / RM4.92 million.

- Quantum China Limited delivers a profit of RM66k in 2018.

- Prior to the series acquisition, Krono has a net profit of RM6 million in year 2014.

- With the above acquisition, Krono will have a net profit of RM15 million guaranteed by its subsidiaries. (In 2018, Krono has a net profit of RM16 million, we could conclude that 2019 will be a better year for Krono).

Strength

- The acquisition of its subsidiaries are done through both cash consideration and issue of shares for the management to become Krono's shareholders. This to me is a good arrangement as Krono's performance will benefits them as well.

- The newly appointed CEO Mr Edmond Tay Nam Hiong, founder of Quantum Storage (India) Pte Ltd and formerly sat on the Information Technology Standardisation Board with Info-communication Development Authority of Singapore on e-payment and security chapter as well as Singapore Infocomm Technology Federation might have some expansion plan for Krono.

Weakness

- Goodwill constitutes a huge portion of its total assets which may post as a risk if there is impairment on goodwill (this risk is not so significant)

- Cash flow management can be improved further to increase its free cash flow.

- There are chances for another round of private placement and further dilute its EPS.

- Less competitive as compare to the big boys such as Google Cloud, Amazon Cloud, Microsoft Cloud. (Honestly speaking i am not very sure of its competitive advantage)

As at Q3 2019

- Revenue increased by 37% however its admin, selling and distribution expenses only increased 5.8%. Net profit increased 35% (well done to the management on cost control).

- Share of profit from associate is close to RM500k in 2019 vs RM 66k in 2018 (this is because of full year contribution of Quantum China Limited).

- Income tax rate is 17%.

- Revenue increased by 37% however trade receivables increased by 201%. Trade parables increased by 45% (The increase in trade receivables might post as a concern to the company cash flow).

- Krono acquire Sandz Solution for RM75million and its goodwill increased RM58 million after the acquisition (Does this mean the net assets Sandz Solution in Sandz Solution worth only RM17 million while the remaining of it is for its goodwill?).

- Borrowings increased by 33% however Krono is still in net cash position.

- As mentioned in 2018 annual report, Krono has higher income tax hence additional RM3 million of income tax payment is made which lower its cash flow from operating.

- Krono spend RM18 million in purchase of PPE which is the highest amount since its listing in 2014.

- Business from Singapore reduced 21% dunno for what reason.

- Business from Philippines increase tremendously to RM41 million due to acquisition of Sandz Solution.

- From the above information, we can do a rough calculation on the profit margin of EDM IT and EDM MS. Profit margin for IT segment is approximately 11% (17,968 / 155,651 = 11.5%). Profit margin for MS segment is approximately 37% (3,915 / 10,852 = 36.99%)

- Not much is being mentioned in its prospects.

Valuation of Krono at RM0.74

- The market cap for Krono is RM362 million hence it is consider as a small cap company. Therefore i do not think Krono deserve a very high PE. Average PE for Krono is 13.32 (> PE18-20 is high, PE14 - 18 is fair, <13 margin of safety).

- Krono distributes a dividend of 2 sen in 2018, at current price of RM0.74, its DY is 2.7% if Krono announce a 2 sen dividend in 2019 Q4. However judging from its free cash flow, it is unlikely for Krono to distribute it.

- Business model for Krono seems like unstable judging from its revenue fluctuation from Singapore & India.

- My concern on Krono is that, is the business able to continue to grow the moment Krono ceased doing M&A? Because at the moment the growth is sustained by its constant M&A.

- A lot of fund houses appear as Krono's top 30 shareholders in 2018 and most of them doesnt appear in 2017 AR.

- Another highlight of Krono is that Krono is now eligible to to switch to main board from the ace market as it has fully met the requirements below:

上市公司如果要从创业板转至主板,有两种方式,第一种是透过公司自己原有的核心生意(core business),第二种是透过收购(acquisition)符合在主板上市的公司。

第一种转主板的方式要符合以下的任何一个条件:-

(1) 公司必须在过去的三或五个财政年拥有至少RM20 million的税后盈利(Profit after taxation), 和最新的财政年要有至少RM6 million的税后盈利。(profit test)

例子: 公司 A :第1年税后盈利RM6 million, 第2年税后盈利RM8 million, 第3年税后盈利 RM10 million,所以3年税后盈利的总合是RM24 million,最后1年的税后盈利多过RM6 million,所以公司A符合这条件。

(2) 公司的市值要至少RM500 million。意思是在提交转板申请给证卷委员会前的1年期限里(这一年的期限是用月份来算,假设2015年4月12号提交申请,这1年的期限是从2014年4月1日到2015年3月31 日),每日的市值(必须根据每日的成交量加权平均股价)要至少RM500 million. (market capitalisation test)

注: 这个条件是很不容易符合的,很多在主板上市的公司市值都没有RM500 million。所以一般创业板的上市公司都不会用这条件转主板。如果是用这条件申请,证卷委员会会考量公司过去一年里有没有不寻常市场交易(unusual market activities)或者其他影响市场公平和有次序地交易该公司股票的事件,包括有没有被Bursa列为指定股项(designated stock)。

(3) 公司或其子公司,有权利在马来西亚或外国建筑和营运大型基建工程(infrastructure project),该工程的成本不低于RM500 million, 经营合约(concession)或执照(license)必须至少还有15年。(infrastructure project corporation test)

第二种转主板的方式所需要购买的公司必须符合第一种的profit test或infrastructure corporation test,只是profit test要加多一个条件,就是被收购的公司的盈利不间断性,即间中没有亏损。

不管是第一种还是第二种方式,上市公司都必须有良好的财政基础,即:

(1) 在接下来的12个月里有足够的流动资金 (working capital);

(2) 如果是用profit test来转主板,要有正营运现金流 (positive operating cash flow); 和

(3) 不可以有累计亏损(accumulated loss)。

另外,关于公众持股(public spread),ACE Market的要求是25%的总股数和不少于200个持有公司股份至少100 unit和少于5%的总股数的股东。Main market的要求则是25%的总股数和不少于1,000个持有公司股份至少100 unit和少于5%的总股数的股东。

第一种转主板的方式要符合以下的任何一个条件:-

(1) 公司必须在过去的三或五个财政年拥有至少RM20 million的税后盈利(Profit after taxation), 和最新的财政年要有至少RM6 million的税后盈利。(profit test)

例子: 公司 A :第1年税后盈利RM6 million, 第2年税后盈利RM8 million, 第3年税后盈利 RM10 million,所以3年税后盈利的总合是RM24 million,最后1年的税后盈利多过RM6 million,所以公司A符合这条件。

(2) 公司的市值要至少RM500 million。意思是在提交转板申请给证卷委员会前的1年期限里(这一年的期限是用月份来算,假设2015年4月12号提交申请,这1年的期限是从2014年4月1日到2015年3月31 日),每日的市值(必须根据每日的成交量加权平均股价)要至少RM500 million. (market capitalisation test)

注: 这个条件是很不容易符合的,很多在主板上市的公司市值都没有RM500 million。所以一般创业板的上市公司都不会用这条件转主板。如果是用这条件申请,证卷委员会会考量公司过去一年里有没有不寻常市场交易(unusual market activities)或者其他影响市场公平和有次序地交易该公司股票的事件,包括有没有被Bursa列为指定股项(designated stock)。

(3) 公司或其子公司,有权利在马来西亚或外国建筑和营运大型基建工程(infrastructure project),该工程的成本不低于RM500 million, 经营合约(concession)或执照(license)必须至少还有15年。(infrastructure project corporation test)

第二种转主板的方式所需要购买的公司必须符合第一种的profit test或infrastructure corporation test,只是profit test要加多一个条件,就是被收购的公司的盈利不间断性,即间中没有亏损。

不管是第一种还是第二种方式,上市公司都必须有良好的财政基础,即:

(1) 在接下来的12个月里有足够的流动资金 (working capital);

(2) 如果是用profit test来转主板,要有正营运现金流 (positive operating cash flow); 和

(3) 不可以有累计亏损(accumulated loss)。

另外,关于公众持股(public spread),ACE Market的要求是25%的总股数和不少于200个持有公司股份至少100 unit和少于5%的总股数的股东。Main market的要求则是25%的总股数和不少于1,000个持有公司股份至少100 unit和少于5%的总股数的股东。

No comments:

Post a Comment