Company Background

- Pwroot is an instant drinks manufacturer with different brands to target different customers.

- Ah Huat instant coffee is to target the Chinese market

- Alicafe and Alitea with tongkak ali to target the Malay man Market (with Halal Certificate)

- Pearl instant coffee with Kacip Fatimah (Kacip Fatimah is rich in phytoestrogen and isoflavones, that may ease menopausal symptoms) to target the Malay women market (with Halal Certificate)

- Instant chocolate drink and Instant Ah Huat Tea Tarik to target the non-coffee drinkers.

- 57% of Pwroot shares are hold by its 4 major shareholders and 3 of them are founders of Pwroot.

- Worth to note that 95% of Pwroot shares are in the hands of long term shareholders (95% of Pwroot shares are owned by 5% of its shareholders. Based on closing price of RM2.10, the value owned by these group of shareholders are worth at least RM200k per shareholder.

- Earnings in 2010 vs 2020:

- In 2010, Pwroot revenue was RM153 million, net profit was RM10 million, share price was RM0.45

- In 2020, Pwroot revenue was RM386 million, net profit was RM51 million, share price was RM1.92

- Its revenue grew 153%, net profit grew 410% while share price grew 326% over the 10 years.

- Domestic vs Export earnings in 2010 vs 2020:

- In 2010, Pwroot sales from Malaysia market (RM133 million) and Export market (RM20 million)

- In 2020, Pwroot sales from Malaysia market (RM177 million) and Export market (RM208 million).

- Sales from Malaysia market grew 33% while sales from Export market grew 940% over the 10 years (Can see that Pwroot focus more on overseas growth)

- Pwroot has 2 manufacturing plant in Johor (one factory for instant powder beverage and another one for canned drinks)

- Pwroot set up distribution companies in China, Indonesia and United Arab Emirates. UAE being their main market for export sales.

Financial Background

- Gross profit margin of Pwroot is around 55%.

- Net profit margin of Pwroot is around 10% - 13%.

- Reasons for a drop in net profit to RM9 million in 2018:

- Unfavorable sales mix (high raw material cost, low GP margin)

- Writing down of inventories (RM2.8 million)

- Impairment loss on PPE (RM2.3 million) mainly resulting from writing down of the ground works done on our leased property for manufacturing plant in the UAE

- Foreign exchange losses (RM5.3 million).

- Reasons for a drop in sales in 2019:

- Spend less in advertisement and promotion (A&P) hence lower sales (RM40 million in 2019 as compared to RM74 million in 2018 spend in A&P).

- Saudi Arabian government required Saudi companies to replace foreign workers with Saudi nationals through a quota policy, and the effect of expatriate levies which led to a reduction in the consumer expatriate population who were major consumers of our products (Export sales dropped from RM204 million in 2018 to RM173 million in 2019)

- Pwroot is generous in paying out its profit as dividend (80% - 100% of dividend payout ratio however company policy on dividend is 50% payout ratio)

- Net cash companies with strong operating cash flow and free cash flow.

- Pwroot spend approximately 20% of its sales on advertisement and promotion for brand awareness.

- Low quality of trade receivables:

- 19% of its trade receivables do not paid on time in 2018

- 22% of its trade receivables do not paid on time in 2019

- Inventory days: 60 days (technically it took Pwroot 60 days before they sold their products)

- Receivable days: 111 days (technically it took Pwroot 111 days before they manage to collect the money back from their debtors)

- Payable days: 88 days (technically it took Pwroot 88 days before they pay their suppliers)

Strength

- Manage to target all races (Muslim and Chinese in particular) with different branding.

- Growth in overseas sales surpass the sales in Malaysia with UAE being its main contributor since 2019.

Weakness

- Lack of popularity in China as compare to other brands like Oldtown and Super coffee.

- Ah Huat sales in China: https://world.taobao.com/dianpu/252451498.htm?spm=a21wu.10013406-tw.0.0.5feb444cYykB8I

- Oldtown sales in China: https://world.taobao.com/dianpu/109437514.htm?spm=a21wu.10013406.0.0.21dd23f75eMiId

- Super sales in China: https://world.taobao.com/dianpu/70251356.htm

- Owl sales in China: https://world.taobao.com/dianpu/143958733.htm?spm=a21wu.10013406.0.0.56585270qwEmWB

- Changing of foreign labor law in UAE will affect the business of Pwroot as expatriates in Saudi are Pwroot main consumers.

- 50% sugar tax was introduced in Saudi Arabia and the UAE on sugar sweetened beverages hence the price of Alicafe increased to pass the cost to the consumers. However Pwroot has introduced a new type of instant coffee "Alicafe Italian Roast" which is more affordable to stay competitive in UAE.

Commodities that affects Pwroot Gross Profit Margin:

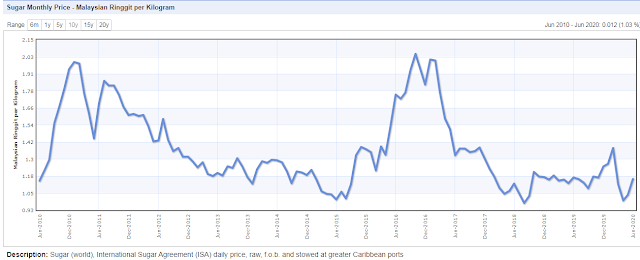

- Sugar price are relatively low which is favorable for its gross profit margin

- Arabica coffee beans price are on the rise which is unfavorable for Pwroot.

- Milk prices are on the high side of consolidation.

Futures Prospects:

- Expansion of new factory at its current Johor facility which would double the production capacity. Capital expenditure estimated to be RM35 million. Expected to complete in 2022.

- New distributor appointed in Egypt to tap into Egypt market.

- Focus on online sales

- Expand product range such as cocoa and tea to increase the value chain.

Peers to Peers Comparison

- Both Oldtown and Super Group were privatized by PE firm JDW Asia in 2017 and 2016 at a PE of 24 for Oldtown and 30 for Super.

Valuation of Pwroot @ RM2.10

- Average PE of Pwroot is 18, at current share price of RM2.10, Pwroot is trading at a PE of 17 which is below its average.

- With dividend of 12.5 sen per share, Pwroot dividend yield is 5.95% which is 3 times higher than current FD rate.

- If Pwroot is to spend RM35 million to expand its production, in the short term, we might see higher depreciation and operating cost which will lower its profit in the short term.

- 65 millions warrants expire in 2023 remain un-exercise which is 15% of its existing number of shares. Expect to see further dilution in EPS.