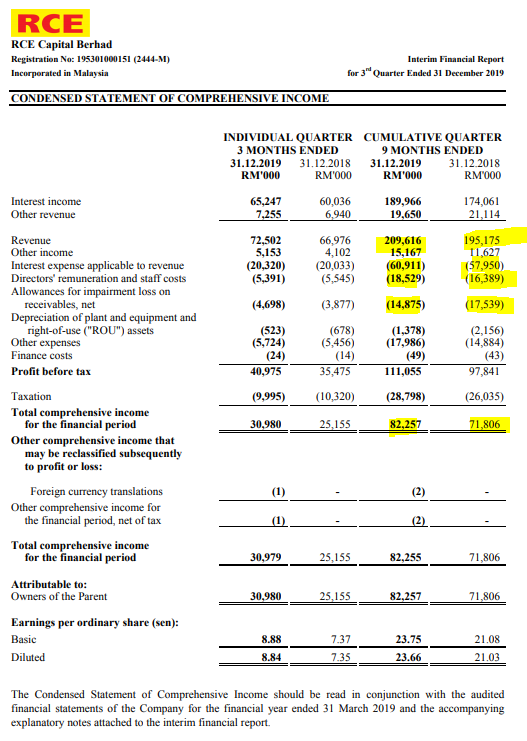

- Revenue increased by 7.39% while net profit increased by 14.97% (This is damn amazing, its net profit margin increased to 39% as compared to 36% previously).

- Interest income increased by 9.13% while interest expenses associate to its revenue increased by only 5.11% (meaning the cost of goods sold decrease, might due to lower OPR rate hence lower borrowing cost).

- Director remuneration and staff cost increased by 13.05% where the increase is higher than the increase in revenue.

- Allowance for impairment loss on receivables decreased 15.18% (improvement on quality of loan).

- Net profit margin increased from 36.38% to 39.24%.

- Total assets grew by 1.26% while its total liabilities decreased by 1.96% (this is damn amazing).

- Loan and receivables grew by 4.93% while its borrowings dropped by 2.16% (I perceive this as they borrow little money to grew their business). And their revenue actually increased by 7% while under the circumstances that its borrowing actually reduced.

- Gearing ratio currently stood at 1.76 as compared to 1.91 last year.

- Overall, the management explained that the increase in revenue and profit mainly due to increase in interest income and higher early settlement by its customer. Lower OPR rate also make it cheaper for RCECAP to do funding to grow its business and the management is positive on its outlook with caution.

Comments

- Without a doubt that 2020 earnings is going to beat 2019. Assuming if RCECAP is able to achieve EPS of 30 sen for 2020, a 30% dividend payout will be 10sen. However RCECAP increased its DPS for the past 2 years so i expect it to do the same in 2020. Therefore i would expect at least an 11sen payout. At current price of RM1.77 per share, its DY work out to be 6.2%.

- NTA stood at RM1.72 per share and current share price stood at RM1.77, hence its price to book value is 1.02.

- At RM1.77 per share, its PE work out to be 6.21. At PE8 calculated based on EPS of 30 sen, RCECAP worth at least RM2.40. Anything below RM1.70 is an opportunity to collect this amazing company.

No comments:

Post a Comment