- Elsoft Research berhad had 4 main subsidiary being STSB, ESSB, LESO and BHSB. (Althought Elsoft is a tech company but it also invest in a butterfly farm in penang. Its Butterfly House Sdn Bhd (BHSB) made a losses of RM 1.22 million in 2018 and RM 0.98 million in 2019).

- Elsoft Research Berhad is a leading provider of LED test and burn in system. It provides cost effective automated test equipment (ATE) to semiconductor, optoelectronic and automation industries. Its key product are test and burn-in systems used by its customers who manufacture optoelectronic devices such as LED, image sensors and automotive lightings to test their products before launching into the market.

- Elsoft business can be categorized as below:-

- Selling of automated LED test equipment (test equipment to check LED for automobiles and smartphones)

- LED tester and LED burn in system (test system to check the lighting features of smartphones and automobiles)

- Industrial IO board

- Solar cell tester

- Embedded controller for medical device (to be launched by end of 2019 or early 2020)

- The smart device contributes 68.7% of its revenue followed by general lighting (14.6%) and automotive (13%).

- 65% of Elsoft's staffs are engineers. This means the minimum wage scheme will not impact the company and shows that the company is heavily invested in R&D.

Financial Highlight

- Elsoft's revenue, PBT and net profit grew at CAGR of 20.75%, 23.52% and 24.22% respectively from 2013 - 2018. ( This is due to high demand from smart devices industry over the years as well as most cars nowadays are switching to LED lights).

- Elsoft has very high gross profit margin and net profit margin (> 50%) which i think is because they invent (original manufacture design, ODM) their own automated testing equipment for LED (this is their main competitive advantage. Elsoft do not push their product or services by participating in price war)

- Elsoft has been consistently reinvest approximately 20% - 25% of their net profit or 10% of their revenue in research and development over the years which is consider fair for a technology company.

- Elsoft has a dividend payout policy of 40% of its net profit however, it has been consistently distributing more than 70% of its profit to its shareholder since 2015, which is double of what it promised (this showing that the management is willing to share its profit with its shareholder)

- ROE were more than 25% since 2014 and reach its peak of 35% in 2018 (Economies of scale with large scale production during the year had improved the overall product margin hence improved their return to equity)

- Elsoft is a net cash company with zero borrowings. Its net cash per share was 11 sen (Its share price is currently RM 0.805 where 11 sen of it were cash).

- From its operating cash flow from 2013 - 2018, we can see that Elsoft is able to convert most of its net profit into cash.

- Elsoft's subsidiary (Elsoft System Sdn Bhd) enjoy tax exemption of 100% under pioneer status until January 2025. This allows the company to save RM 10 millions of income tax (Elsoft paid RM 528k of income tax for its PBT of RM 40 million, this translate into 1.3% of income tax rate).

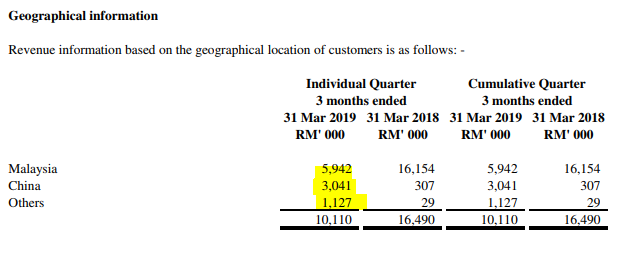

- Elsoft derive its revenue mainly from Malaysia (85%) followed by China (13%).

- One of its major customer contributes RM 58 million or 75% of its total revenue however the management indicated that they have been working with this major client (lighting solution MNC) for more than 15 years indicates a long term and stable business relationship.

Future Prospect

- According to publication released by Semiconductor Trade Statistic the demand for semiconductor was up 13.7% in 2018 and expected to slow down by 3% in 2019 and to pick up again in 2020.

- The above data is in line with Elsoft earnings as the demand weaken for the beginning of 2019 and expected to pick up during 2nd half of 2019. Maybe to recover in 2020.

- Moving foward, Elsoft's R&D will be focusing on

- (a) ATE for infrared/laser devices testing

- (b) Next generation ATE for smart devices industry (LED flash tester catered to a major smartphone brand’s upcoming product line)

- (c) New ATE for automotive industry (headlamp tester - developing a new range of test equipment to test multi-beam digital headlights that are replacing single-beam LED headlights operating on a rotating mechanical system for the automotive industry.)

- Elsoft is also diversifying into embedded controller for medical device industry in 2019 which expect to be out in late 2019/ early 2020(however, this wont contributes significantly to the company to begin with).

As at Q1 2019

- Gross profit margin dropped to 49% for the first quarter as compared to 58% in 2018.

- The business dropped 40% due to lower demand for automated test equipment (ATE) which is same as what 2018 annual report mentioned (i am expecting the 2nd quarter 2019 to be bad as well).

- Although the business in Malaysia dropped 64% but the company has expanded further into overseas market.

- China contributes RM 3 million of revenue for Q1 2019 vs RM 10 million for 2018.

- Other countries contributes RM 1.1 million for Q1 2019 vs Rm 928k for 2018.

- The management didn't reveal much on its prospect however i think it is quite hard for 2019 to be a performing year.

- According to the analyst from TA Research, the company currently has an order book of RM 20 million (This only translate to 25% of 2018 revenue).

Strength

- High profit margin proving the company's strength in R&D (highest profit margin in the industry).

- Reliable management as the company is willing to share 80% of its profit with its shareholders although the dividend payout policy is only 40%.

- Elsoft never has a loss making quarter since 2009 and never fail to payout dividend since 2009.

- Enjoy low income tax rate due to pioneer status until 2025.

Weakness

- Elsoft earnings is over dependent on one major customer. Therefore, when the customer's business slows down, it will directly impacted the company's earning.

- Customers are mainly in Malaysia (Elsoft should explore more into overseas market).

- According to its 2018 AGM, its current factory utilization rate is merely 50% only as its major customer business slows down due to trade war.

Valuation @ RM 0.805

- From the above info, we can see that Elsoft's EPS started to go downhill after reaching a peak of 2.06 sen in Q3 2018 due to the uncertainty in trade war. Its latest quarter's EPS further deteriorate to 0.73 sen and expected to be slower for Q2 2019 according to the management prospect in 2018 annual report and will only recover slightly in 2nd half of 2019.

- Assuming if Elsoft generates EPS of 1.5 sen for the first half of 2019 and EPS of 2.5 sen for 2nd half of 2019, Elsoft would have a total of EPS of 4 sen for FY 2019. At current price of RM 0.805, its PE will be 20 which is deemed to be fairly valued.

- Elsoft have a history of dividend payout ratio of approximately 75% and this translates into a dividend pay out of 3 sen for FY 2019. At current price of RM 0.805, its DY is 3.7%.

- I will just use the average PE of 16 to value Elsoft. Assuming a 4 sen of EPS full year, at PE 16, Elsoft is worth RM 0.64 and its DY will be 4.6%. So anything below RM 0.64, there will be a margin of safety.

Technical Analysis

Elsoft is currently trading in a downtrend and has break below its trend-line at 0.83. Short term traders are advice to enter above 0.83.