- Vision - be the first glove companies that produce and deliver the best and most innovative gloves in the world.

- World’s largest glove manufacturer by market capitalisation.

- In 2014, Hartalega invested RM2.5 Billlion (RM2,500 Million) in Next Generation Integrated Glove Manufacturing Complex (NGC) in Sepang which will boost the capacity from 14 billion to 44.6 billion gloves. So what is NGC?

- Hartalega commenced the commissioning of Plant 5 in July 2018 and will soon be undertaking the construction of Plant 6 and Plant 7 tailored towards small order and specialty products.

- Hartalega latest revolutionary product - the world first non leaching antimicrobial glove with potential to killing up to 99.99% of microbes within 5 minutes of contact

- The glove is the first ever to contain nonleaching antimicrobial technology with a pathogen-killing molecule. The active ingredient in the glove is a photosensitiser which generates singlet oxygen when exposed to light. This singlet oxygen oxidises proteins and lipids in bacteria, thus killing microbes that are transferred to the glove.

- Launched in Europe in May 2018 and currently in the process of securing approval from the US Federal Drug Administration to introduce this product to the US market.

- What is nitrile glove?

- Nitrile gloves are a synthetic glove which has rubber-like characteristics.

- Nitrile glove has almost the same flexibility, tensile strength, and durability as a latex glove.

- The greatest benefit of nitrile gloves is that it is protein free and allergy free. Nitrile gloves are a great alternative to latex glove for people with latex allergies.

- Nitrile gloves are highly puncture resistance - 3 to 5 times more than latex and they are also more elastic than vinly gloves.

- Nitrile rubber is more resistant than natural rubber to chemicals, oils and acids, and has superior strength.

Glove Outlook

- Malaysia is the world’s largest supplier of rubber gloves with over 60% of the global market.

- Malaysian rubber glove exports increase 15.8% from 61.9 billion in 2016 to 71.7 billion pairs in 2017.

- Synthetic rubber glove exports grew by 22.6% during the year to 43.4 billion pairs, from 35.4 billion pairs in the previous year.

- In 2017, market demand saw a greater shift towards nitrile gloves, which accounted for 99.5% of total synthetic rubber glove exports.

- US remained the chief export destination for Malaysian synthetic rubber gloves, comprising 47% of Malaysia’s total export value

- Stable growth and demand for nitrile glove (as proven by the nitrile gloves sales from Harta below)

Financial Performance

- Revenue increased by 117% from 2014 - 2018 (which is in line with their expansion plan of NGC)

- Gross profit margin is able to maintain above 25% and net profit margin above 15% from 2014 - 2018 (showing a strong management team to maintain the efficiency even after the company grow twice bigger)

- Consistently generate positive cash flow from operations over the 5 years.

- Over the 5 years, the company spend RM 1,553 million in upgrading their plant and equipment and yet they are able to maintain a healthy level of gearing ratio of below 0.1 (signify the company has the ability to take up more expansion plan)

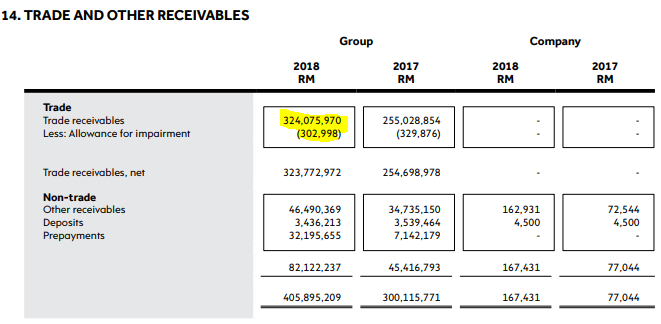

- Allowance for impairment is below 0.1% of its trade receivables.

- All of their bank borrowings are denominated in USD. (However the strengthening of RM will not be a huge impact as 99.8% of their revenue are derive from export business, meaning their sales are mainly in USD)

- Hartalega manage to tap into new market at Middle East and Russia in 2018

- America remain their main export country which accounted for 40% of their revenue

- Malaysia only accounts for 0.17% of their revenue (This means the company has unlimited potential as local market is limited while export market has unlimited opportunities)

- The demand for glove and sales to export countries actually increased from 2017 to 2018

- There is one single customer in the US contributes around 20% of Hartalega revenue (however this is a very healthy level as the company do not depends on one single client to do their business)

As at 3rd Quarter of 2019

- Operating profit margin to maintain at approximately 20%

- Revenue for 3 cumulative quarters is RM 2,143 Million vs RM 2,405 in 2018 (the revenue in 2019 can easily exceed 2018)

- Net profit for 3 cumulative quarters is RM 364 Million vs RM 439 Million in 2018 (the company will most likely to perform better in 2019 as Hartalega is generating RM 120 million of profits per quarters, RM 364 Million + RM 120 Million = RM 484 Million)

- Growth in revenue was contributed by improvement in sales volume of 11.6% in tandem with growing demands for nitrile gloves and continuous expansion in improving production capacity. The increase in sales revenue is also contributed by higher average selling price. (this means that Hartalega has the ability to adjust the selling price of their glove to their customers based on the cost of their raw material and the demand for nitrile glove is still increasing)

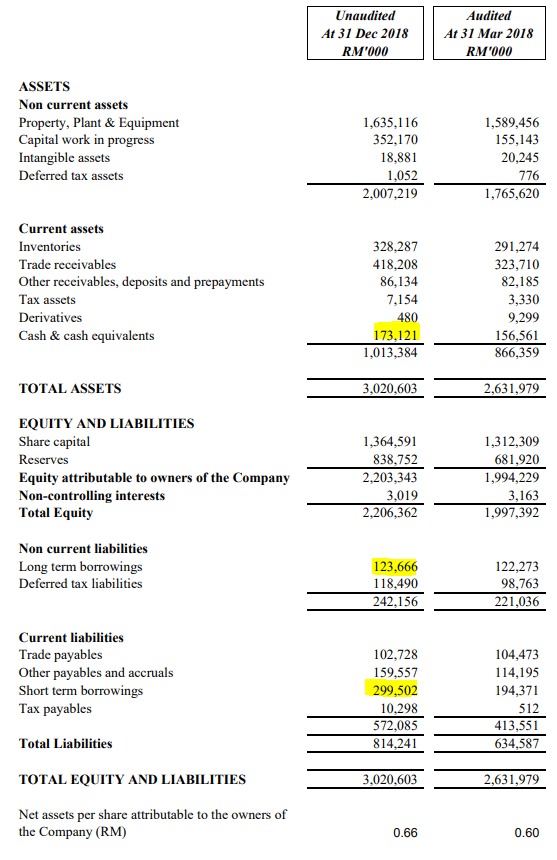

- Gearing ratio remain at 0.11 (11%) which is about the same as 2018 (kudos to the management team)

- Cash flow generated from operating remain strong.

- For 3 cumulative quarters, the company spend RM 317 million in expansion on their NGC (bringing it up to RM 1,870 millions of investment in PPE since 2014. Therefore, i expect the full expansion plan of NGC to be completed in another 2 years time to make it up to RM 2,500 millions of expansion plan)

Future Prospect

- Nitrile glove accounts for 63% of Malaysian rubber glove export (increased from 50% in 2018)

- Plant 5 of NGC facility has commissioned 6 out of 12 lines with remaining production lines to come on progressively.

- Construction of Plant 6 structure have started

- Plant 5 and Plant 6 will each have annual installed capacity of 4.7 billion pieces. A new plant – Plant 7 is also in the expansion pipeline catering to small orders focusing more on specialty products. Plant 7 will have an annual installed capacity of 2.6 billion pieces.

- Since the launch of antimicrobial gloves (AMG) in UK, Hartalega has received orders from customers in over 10 countries (this is some great progress as compared to only Europe in 2018)

- The company is also working on securing Federal Drug Administration (FDA) approval for US market where there is greater awareness among US healthcare professionals on the dangers of healthcare-associated infections. The FDA approval will provide a strong third party testament to the safety and effectiveness of the product. As the new medical product is in its introduction and education phase, we expect AMG to contribute meaningfully in the coming years. Sales of the AMG is also expected to gain momentum as it will be priced competitively to ensure quick market acceptance.

Strength

- Strong management team with strong cash flow management

- Management team are far sighted enough to actually wanna invest RM 2,500 million in 2014 when their profit during that point of time is only around RM 230 million (the amount they invest is 10 times more than what they can make every year in 2014)

- The plan to build their NGC from plant 1 to plant 7 gradually is actually a very smart move as this do not jeopardize their cash flow and the market is able to absorb all the supply slowly.

- The new anti bacteria glove is expected to contribute positively to the company (continue its double digit growth legend maybe?) once they start selling it to US by end of 2019 as well as other countries.

- Hartalega has lowest number of workers per glove output as compared to its peers (not too sure is how much, cant find info).

- Highest profit margin among industry (Harta - 17%, Topglove - 8.9%, Kossan - 9.5%, Supermx - 9.8%)

- Factory utilization rate of approximately 90%

- Have strong R&D as the company has the ability to be the pioneer in its industry (as proven from its nitrile glove over the year and also the new anti bacterial glove)

- Production right now is 32 billion gloves per year and to be increased to 44 billion gloves per year when the whole NGC is completed (that is another 37% growth in production capacity)

- Dividend payout ratio of 45% (the dividend yield is still very low as the valuation of Hartalega is on the high side however it is consider pretty good still)

- Latex price will not affect the company earning as 95% of their gloves are nitrile glove where the raw material cost is more stable than latex.

Weakness

- Growth in revenue and profit slows down as compare to previously (as mentioned above, the profit is only expected to grow from RM 440 million in 2018 to RM 484 million in 2019 which is 10% as compared to a 55% growth in 2018)

- Supply might be greater than demand and is the market able to absorb so much supply in short term? (as everyone is increasing their production capacity)

Valuation at RM 4.63

- As we can see that the PE for Harta is trading at its historical high in 2018 with its PE reaching 45.

- As at 30/3/2019, its share price is RM4.63 with PE of 32.18 (so is Harta a good buy at PE 32.18?)

- Moving forward, if Harta is able to continue with double digit growth, at RM4.63, its PE can be easily below 30 (Assuming EPS for 2019 is 14.65 sen, with a double digit growth of 10% in 2020, the EPS is 16.11 sen. At RM4.63 a share, its PE will be 28)

- PE comparison among peers (Harta - 32, Topglove - 27, Kossan - 22, Supermx - 17

Technical Analysis

- Harta is currently trading in a downtrend by forming lower low and the price is below its 20MA with support at 4.3 follow by 3.8.